Varo Bank Expands Credit Access and Budgeting Tools

Exciting news for those of us looking for better ways to manage our finances! Varo Bank has just introduced some groundbreaking features that can really help those living paycheck to paycheck. As someone who always seeks out the best financial tools and opportunities, I’m thrilled to share how Varo’s new offerings can make a big difference in our financial lives.

Varo’s new Line of Credit is a game-changer. Imagine being pre-approved for up to $2,000 to cover unexpected expenses like medical bills or car repairs, and having the flexibility to pay it back over time. What sets Varo apart is its transparent fixed pricing—no late or hidden fees. Plus, Varo uses your banking history with them to determine your creditworthiness, not just your credit score. This means the more you bank with Varo and show regular deposits and on-time payments, the higher your potential borrowing limit.

Smart Bank Account Features

In addition to the Line of Credit, Varo has introduced some fantastic Smart Bank Account features. These new tools make it easier to track and manage your money right within the Varo app. You can now see a real-time visual trend of your spending during the current and previous month, making it easier to compare and plan for upcoming expenses. The app also lets you filter by spending category, such as Food & Drinks, Bills & Utilities, and Shopping, giving you a clear picture of your monthly spending habits and helping you budget smarter without needing other tools or apps. Soon, you’ll also be able to compare various income streams like Payroll, Government Benefits, and Tax Refunds.

Addressing Financial Stress

For many Americans, financial stress is a daily challenge, with rising costs and unexpected expenses creating constant pressure. Varo Bank offers a refreshing solution by focusing on helping us manage our money better instead of encouraging us to spend more and incur more debt. Understanding our spending habits is the first step to effective budgeting, and Varo integrates these insights directly into their app.

Varo Bank CEO Colin Walsh stated, “Varo Line of Credit is a first-of-its-kind lending product that will help people borrow at a transparent cost when life happens and they need extra cash. And with the addition of new tech-driven smart features to the Varo bank account, customers can learn more about their daily financial habits and take immediate action to ease the anxiety of managing their money and get on track to build wealth over time.”

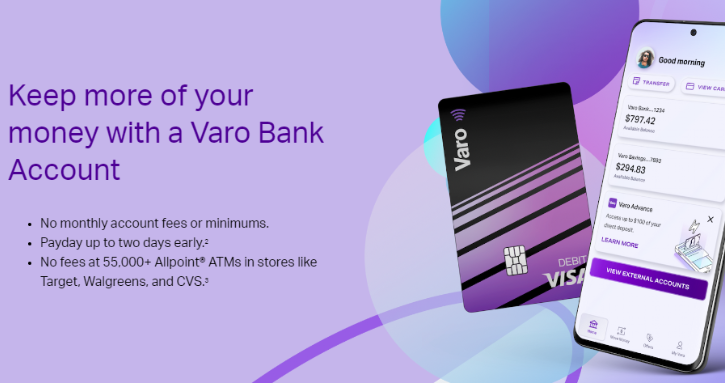

Varo’s comprehensive banking platform is designed to empower those of us who are living paycheck to paycheck. Alongside the Line of Credit and Smart Bank Account features, Varo also offers Zelle® for instant money transfers, Varo to Anyone for sending money to almost anyone regardless of where they bank, free tax filing, no monthly or hidden fees, access to 40,000+ fee-free ATMs, a credit-builder card, up to 5.00% APY on savings, cashback offers, job opportunities, and more. Unlike some other financial apps, Varo is a trusted national bank. The Varo Line of Credit waitlist is now open, and the product will be available in Q2 2024.

If you’re ready to take control of your finances and reduce financial stress, sign up for Varo Bank today. I’ve found that having the right tools can make all the difference, and Varo’s latest offerings are definitely worth checking out.

References: