TradingView vs Thinkorswim: Choosing the Best Trading Platform for You

In the ever-evolving landscape of online trading, finding the perfect platform to match your trading style is crucial. Enter the ring, TradingView and Thinkorswim, two heavyweights in the trading platform arena. Both platforms offer an array of tools and features designed to empower traders, but which one is the right fit for you?

In this comprehensive comparison, we’ll break down the strengths, weaknesses, and unique attributes of TradingView and Thinkorswim, helping you navigate the path to your trading success. Whether you’re a seasoned pro or just dipping your toes into the trading waters, read on to discover the perfect platform to power your trading journey.

Brief Overview of TradingView & Thinkorswim

TradingView

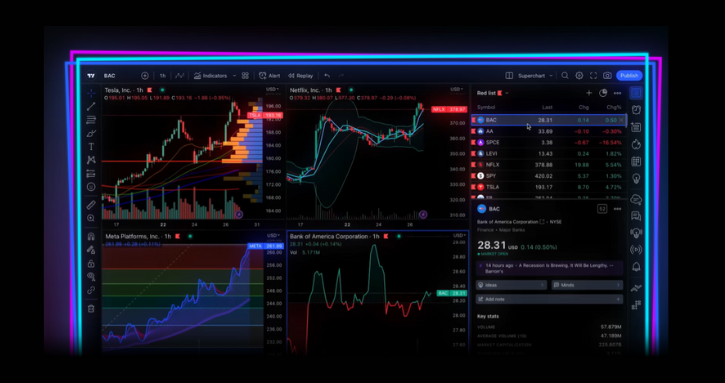

First in the spotlight is TradingView, a platform that redefines charting and trading by offering a blend of sophisticated tools and a vibrant community. Beyond its captivating charts, TradingView acts as a social network for traders, providing a space to share ideas, strategies, and analyses in real time. As you harness its intuitive charting capabilities, you’ll find yourself navigating an ecosystem that encourages collaboration and learning.

Whether you’re a seasoned trader or just beginning your journey, TradingView’s customizable charts, extensive technical indicators, and interactive interface make it an exceptional platform for both analysis and execution.

Thinkorswim

Now, let’s introduce you to the juggernaut of trading platforms – Thinkorswim, proudly brought to you by TD Ameritrade. More than just a trading platform, Thinkorswim is a comprehensive suite that embodies innovation, research, and execution capabilities. Imagine having a trading cockpit at your disposal, offering advanced charting, market research, analysis tools, and seamless order execution.

With Thinkorswim, you’re not just trading; you’re diving into a sophisticated ecosystem designed to empower traders at every level. As a product of TD Ameritrade, a name synonymous with trust and industry leadership, Thinkorswim stands as a testament to innovation and excellence in the trading world.

Charting and Technical Analysis

In the world of charting and technical analysis, both TradingView and Thinkorswim emerge as formidable contenders, each boasting a distinct array of capabilities to aid traders in their analytical endeavors.

TradingView stands out as a beacon of advanced charting tools and indicators. Its platform offers traders a comprehensive selection of technical studies and drawing tools, allowing for intricate chart analysis. Beyond its technical prowess, TradingView fosters a community-driven environment reminiscent of a social network. Traders can not only chart their insights but also share them with the community. This communal aspect breathes life into the platform, as traders collaborate and exchange ideas, making it a hub of real-time discourse.

On the ground of comprehensive technical analysis, Thinkorswim takes center stage. This platform, synonymous with TD Ameritrade, is equipped with an arsenal of charting features, catering to both novices and experts. Offering an assortment of advanced studies, indicators, and drawing tools, Thinkorswim provides traders with a robust toolkit for in-depth chart analysis. An intriguing aspect of Thinkorswim is its customization potential. Traders can craft personalized indicators, amplifying the adaptability of the platform to suit individual analytical preferences.

Exploring Order Execution and Trading Tools

TradingView introduces a diverse range of order types, catering to the varied needs of traders. From market and limit orders to advanced conditional orders, the platform equips users with the tools necessary to execute their trading strategies with precision. The execution speed of TradingView is commendable, providing traders with the advantage of rapid trade execution. Moreover, the platform’s intuitive interface extends to its trading tools, offering seamless access to various features. While TradingView’s automation options are relatively limited, its focus on manual trading tools empowers traders to make calculated decisions in real-time.

Thinkorswim, as the brainchild of TD Ameritrade, boasts an array of advanced trading tools that cater to traders of varying expertise. The platform offers a comprehensive range of order types, enabling users to execute trades in alignment with their strategies. Thinkorswim’s execution speed is notable, contributing to efficient trade implementation. However, the standout feature is the platform’s trading automation options. Thinkorswim allows traders to craft automated strategies, employing thinkScript – a proprietary scripting language – to develop custom indicators and strategies. This opens the door to algorithmic trading, enabling traders to harness the power of automation.

Both TradingView and Thinkorswim shine when it comes to risk management and platform customization. TradingView offers risk management tools, such as position sizing calculators, to help traders manage their exposure effectively. Additionally, platform customization is a strong suit, with traders having the flexibility to tailor their workspace to suit their preferences.

Thinkorswim takes risk management to the next level with features like the “Risk Profile” tool, which visualizes potential profit and loss scenarios. The platform also enables traders to set conditional orders based on risk parameters. Customization is a hallmark of Thinkorswim, with traders having the ability to craft complex studies, indicators, and even deploy their automated strategies using thinkScript.

Customization and Interface

TradingView empowers traders to create a workspace that resonates with their style and preferences. The platform offers a diverse range of chart layouts, allowing users to choose from various configurations and timeframes. Its intuitive drag-and-drop functionality enables seamless rearrangement of elements on the chart, enhancing the user experience. The platform’s design is user-friendly, with tools and indicators accessible through a unified interface. This makes customization a breeze, ensuring traders can optimize their workspace to streamline their trading journey.

Thinkorswim, on the other hand, provides traders with a highly customizable interface that aligns with their trading objectives. The platform allows users to create custom watchlists, charts, and even entire layouts. Thinkorswim’s flexible grid system enables traders to arrange and resize modules according to their preferences, ensuring vital information is easily accessible. The user interface design is comprehensive yet organized, catering to both novice and experienced traders. Navigating the platform becomes intuitive as traders can choose from multiple preset layouts or create their own.

In terms of user interface design and layout flexibility, both TradingView and Thinkorswim present commendable options. TradingView focuses on simplicity and clarity, allowing users to personalize their workspace while maintaining an uncluttered appearance. On the contrary, Thinkorswim offers a plethora of customization options, enabling traders to craft intricate layouts tailored to their strategies.

TradingView and Thinkorswim both offer extensive access to a wide range of financial instruments, empowering traders to diversify their portfolios. TradingView provides access to a variety of asset classes, including stocks, forex, cryptocurrencies, and more. Its “Pine Script” coding language further enables traders to create custom indicators and strategies for a broader spectrum of instruments.

Thinkorswim, as a comprehensive trading platform, provides access to equities, options, futures, forex, and cryptocurrencies. The platform’s extensive offering is complemented by advanced analytical tools that aid in decision-making across various asset classes.

Financial Instruments: TradingView vs Thinkorswim

TradingView and Thinkorswim excel in providing access to a multitude of asset classes, ensuring traders can diversify their portfolios and explore various markets.

Stocks: Both platforms offer a wide selection of equities from major stock exchanges around the world. Traders can analyze and trade stocks across different industries, regions, and market capitalizations.

Options: Both TradingView and Thinkorswim grant traders access to options markets, enabling them to trade contracts based on their market predictions and risk tolerance.

Futures: For those interested in futures trading, both platforms offer access to various commodities, indices, and interest rate futures, allowing traders to speculate on price movements without owning the underlying asset.

Forex: Currency traders can leverage the forex markets on both platforms to speculate on the exchange rates of major and minor currency pairs, tapping into global economic trends.

TradingView shines as a versatile platform offering access to an extensive range of markets, including stocks, forex, cryptocurrencies, indices, commodities, and bonds. The platform’s intuitive interface and charting tools enable traders to analyze and trade a diverse array of instruments.

On the other hand, Thinkorswim, backed by TD Ameritrade, offers a comprehensive selection of markets, including equities, options, futures, forex, and cryptocurrencies. The platform’s integration with TD Ameritrade’s brokerage services provides traders with seamless access to a wide range of investment opportunities.

Real-Time Data and Market Insights

Both TradingView and Thinkorswim pride themselves on delivering real-time data and insights, equipping traders with the information needed to make informed decisions. TradingView offers real-time data on various asset classes, while Thinkorswim’s advanced tools provide real-time quotes, news, and analysis to support trading strategies.

Assessing Strengths and Weaknesses: TradingView vs Thinkorswim

TradingView and Thinkorswim are powerful trading platforms, each with its own set of strengths and weaknesses. Understanding these attributes is crucial in determining which platform aligns best with individual trading styles and preferences.

TradingView’s Strengths

Community Interaction: TradingView shines in its vibrant community, fostering collaboration among traders. The platform’s social aspect allows users to share insights, strategies, and analyses, facilitating learning and idea exchange.

Advanced Charting Tools: With an array of technical indicators, customizable drawing tools, and multiple chart types, TradingView empowers traders to conduct in-depth technical analysis and visualize market trends.

Web-Based Platform: TradingView’s web-based interface is accessible from any device with an internet connection, eliminating the need for downloads or installations.

Market Coverage: The platform provides access to a diverse range of markets, including stocks, forex, cryptocurrencies, indices, and commodities.

TradingView’s Weaknesses

Limited Broker Integration: While TradingView offers brokerage integration, the number of supported brokers may be more limited compared to other platforms.

Data Latency: In some cases, real-time data may experience slight latency, which can impact split-second trading decisions.

Thinkorswim’s Strengths

Comprehensive Trading Tools: Thinkorswim boasts an impressive suite of advanced trading tools, catering to traders’ analytical and research needs.

Education and Research: Thinkorswim provides extensive educational resources, including webinars, tutorials, and research reports, making it an excellent platform for traders seeking to expand their knowledge.

Platform Customization: Thinkorswim offers extensive customization options, allowing traders to tailor their trading experience to their preferences.

TD Ameritrade Integration: Backed by TD Ameritrade, Thinkorswim offers seamless integration with TD Ameritrade’s brokerage services, providing access to a wide range of investment opportunities.

Thinkorswim’s Weaknesses

Learning Curve: The platform’s extensive features may present a learning curve for new traders, potentially requiring time to fully grasp its capabilities.

Complexity: The comprehensive nature of Thinkorswim might be overwhelming for beginners seeking a more simplified trading experience.

Choosing the Right Platform for You

Selecting between TradingView and Thinkorswim depends on individual trading goals and preferences. If community engagement, user-friendly charting, and a wide range of markets are essential, TradingView could be the better choice. On the other hand, if you value comprehensive trading tools, in-depth education, and a fully customizable platform, Thinkorswim might suit you better.

In essence, both platforms offer a wealth of features, but the decision should revolve around how well these features align with your trading strategy and goals. Whether you’re a beginner seeking simplicity or an advanced trader seeking in-depth analysis, your choice of platform will significantly impact your trading journey.

Final Thoughts

The choice between TradingView and Thinkorswim is pivotal. TradingView offers a dynamic blend of advanced charting and a thriving trading community, while Thinkorswim, backed by TD Ameritrade, provides an extensive trading ecosystem with educational resources.

TradingView’s strength lies in its collaborative environment, customizable charts, and technical indicators. On the other hand, Thinkorswim boasts comprehensive tools and educational support. You can also read another comparison we did for TradingView vs TrendSpider to gather more information.

To make the right choice, consider your priorities. TradingView suits those valuing community engagement and diverse markets, while Thinkorswim is ideal for those seeking comprehensive tools and personalized education.Ultimately, your selection should align with your trading strategy, shaping your trading journey whether you’re a beginner or an experienced trader.