Novo Review in 2025: Novo Bank’s Features & Perks

Are you tired of traditional banks that charge you hefty fees and offer little in return? If so, it may be time to consider Novo Bank. Whether you’re a small business owner or a freelancer, finding a banking solution that meets your needs can be a challenge. Traditional banks may not offer the flexibility, affordability, or convenience that you require to manage your finances effectively. Novo Bank aims to bridge that gap by providing an innovative and accessible mobile banking platform that offers a range of features tailored to the needs of modern entrepreneurs.

In this Novo review, we’ll take a closer look at Novo Bank, including its features, benefits, fees, referral program, competitors and more.

What is Novo Bank?

Novo Bank was founded in 2016 and is based in New York City. The bank prides itself on its customer-centric approach, providing users with access to a range of features and benefits that traditional banks simply cannot match. Novo’s mission is to make banking more accessible and affordable for everyone, and it has certainly achieved that goal with its fee-free structure and user-friendly mobile app.

Whether you’re looking to open a personal checking account, a savings account, or a business checking account, Novo Bank has got you covered. With Novo, you can enjoy features like unlimited ATM fee reimbursements, free ATM withdrawals, and cashback rewards on select purchases. Plus, with the Novo referral program, you can even earn some extra cash while introducing your friends to the benefits of Novo Bank.

Benefits of Novo Bank

Novo Bank is a digital bank that offers a range of features designed to make banking easy and convenient. Here are some of the top features of Novo Bank:

Fee-free checking: Novo Bank offers fee-free checking accounts with no hidden fees or minimum balance requirements. This makes it easy to manage your money without worrying about unexpected charges.

Mobile app: The Novo mobile app is user-friendly and easy to navigate, allowing you to manage your account from anywhere. You can check your balance, deposit checks, transfer money, and more, all from the palm of your hand.

ATM network: Novo has partnered with over 55,000 ATMs nationwide, making it easy to access your money whenever you need it.

High-yield savings: Novo Bank offers high-yield savings accounts with competitive interest rates, allowing you to grow your savings over time.

Business banking: The company offers business banking services, including fee-free business checking accounts and a range of tools designed to help entrepreneurs manage their finances.

Integrations: Novo Bank integrates with a range of third-party tools, including accounting software and payment platforms, making it easy to manage your finances all in one place.

Customer support: Novo offers excellent customer support, with a dedicated support team available by phone, email, or live chat.

How Novo Business Checking Works

Novo Business Checking is designed specifically for small business owners. To open an account, you’ll need to provide some basic information about your business and your personal information. Once your account is open, you can start using it right away to manage your finances.

Novo Business Checking comes with a variety of features to help you manage your business finances. You can make mobile deposits, pay bills, and send and receive money using the Novo mobile app. You can also track your expenses and set up custom categories to make accounting easier.

Novo Bank is a digital bank that prides itself on offering fee-free checking and savings accounts. That means you won’t have to worry about any hidden fees or minimum balance requirements when you bank with Novo. However, there may be fees for certain services, such as wire transfers or stop payments.

What are the Novo Fees?

Novo Bank offers a range of features and benefits for its customers, including no monthly service charge or fees for standard ACH transfers. However, for Express ACH transfers, Novo charges 1.5% of the transaction amount, with a minimum of $0.50 and a maximum of $20. There are no fees to open a Novo account, and there are no minimum or maximum deposit requirements, although there are limits in place for specific deposit types. Novo’s business checking account includes free mobile check deposit, free bill pay with physical checks, and free bank checks, as well as free ATM access with no fees for using any ATM in the U.S. or abroad. The only fees that customers may face are $27 for insufficient or uncollected funds returned. Novo also allows customers to increase their transaction limits through the Novo app.

Pros and Cons of Novo Business Checking

Novo Bank offers a range of features and benefits for its business checking account customers. The account has no monthly fees or minimum balance requirement, as well as unlimited fee-free transactions, no ACH transfer fees, and no incoming wire fees. Customers can also enjoy refunds on all ATM fees worldwide and online banking with unlimited invoicing and bill pay, including the option to send paper checks for free. Novo also integrates with top business tools like QuickBooks, Xero, Stripe, and Shopify and offers access to discounts on business software and services through customers’ accounts.

However, there are some limitations to consider when using Novo’s business checking account. Customers cannot deposit cash into their accounts, and they cannot send domestic or international wires (although international wires are available via the Wise integration). Additionally, there are no recurring payments available with bill pay. Customers should also be aware of the $27 fees for insufficient funds or uncollected funds returned.

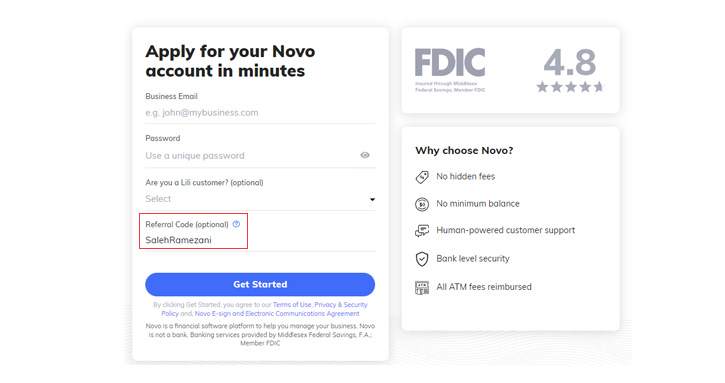

What is the Novo Referral Program?

The Novo referral program that rewards both the referrer and the person referred. With the Novo referral program, you can earn up to $40 per referral, with no limit to the number of referrals you can make. Here’s how it works:

Share your unique referral link: Once you’re a Novo customer, you can access your unique Novo referral link through the Novo mobile app. Share this link with your friends and family, either through social media or by sending them a personal invitation.

Your friend signs up for Novo: When your friend signs up for a Novo account using your Novo referral link, they’ll need to deposit at least $100 into their account within the first 45 days of opening it.

You both earn a reward: Once your friend meets the deposit requirement, you’ll both receive a $40 reward that will be deposited directly into your accounts. It’s that simple!

Novo Bank Competitors

Novo Bank has quickly established itself as a leader in the digital banking space, offering a range of features and benefits that traditional banks cannot match. However, it’s always good to consider the competition to ensure you’re getting the best service and value for your money. Here are some of Novo Bank’s top competitors in the digital banking space:

Chime: Chime is a digital bank that offers a range of features similar to Novo, including fee-free checking and savings accounts, cashback rewards, and a user-friendly mobile app. Chime also offers early direct deposit, which allows users to access their paycheck up to two days early.

Ally Bank: Ally Bank is an online bank that offers competitive interest rates on savings and checking accounts, as well as a range of other financial services. Unlike Novo, Ally Bank offers a physical debit card for use at ATMs and in-person transactions.

Axos Bank: Axos Bank is a digital bank that offers personal and business banking services, including high-yield savings accounts, fee-free checking accounts, and business checking accounts. Axos Bank also offers a range of lending services, including personal loans and mortgages.

Simple: Simple is a digital bank that offers fee-free checking and savings accounts, budgeting tools, and a user-friendly mobile app. Simple is known for its emphasis on budgeting and saving, making it a good choice for those looking to improve their financial habits.

Capital One 360: Capital One 360 is an online bank that offers fee-free checking and savings accounts, as well as a range of other financial services. Capital One 360 also offers a physical debit card for use at ATMs and in-person transactions.

While Novo Bank certainly has its strengths, it’s always a good idea to consider the competition to ensure you’re getting the best value for your money. By comparing the features and benefits of each bank, you can choose whatever meets your unique financial needs.

Final Thoughts on Novo Business Checking

Novo Bank offers a range of features that make banking easy and convenient for small business owners, including a fee-free checking account, high-yield savings account, mobile app, and ATM network. Novo also integrates with third-party tools and offers excellent customer support. Although Novo doesn’t charge monthly fees or minimum balance requirements, there may be fees for certain services.

The Novo referral program is a great way to earn extra cash while sharing the benefits of the bank with friends and family. If you are new to Novo and want to earn some free cash by signing up, read our article on Novo referral program.

Novo does have limitations, such as the inability to deposit cash and send domestic or international wires. Despite these limitations, Novo Bank has quickly established itself as a leader in the digital banking space, with its top competitors including Chime, Ally Bank, Axos Bank, Simple, and Capital One 360. For those looking for a fee-free banking experience with a range of features designed for small business owners, Novo Bank is definitely worth considering.