$40 Netspend Referral + $40 Sign up Bonus [Feb 2024]

Netspend Referral Program

To receive the Netspend referral bonus, sign up with a Netspend referral link and deposit at least $40.

Netspend says “Friendship is Better with an Extra $40”, so register today with a Netspend referral link to earn a $40 Netspend sign up bonus and refer your friends as well. When you refer a friend, you can each get a $40 bonus when you meet all the referral requirements.

It’s a common misconception that interest rates are in the floor. Most people think that fintech banks don’t offer interest rates above 1-2%. Netspend does things differently. Whether it’s your emergency fund or saving for a car, Netspend gives you access to a 5% interest savings account along with a pre-paid debit card.

It’s easy to think that accounts like this are too good to be true. While Netspend requires a little more work to set your account up, it’s worth it for the generous 5% interest rate. Like most other fintech banks, Netspend also has its own referral program. If you’re looking for a way to earn interest on your saving to maximize its value, Netspend is the perfect account for you.

We’re looking at everything you need to know about the Netspend referral, including how to sign-up for Netspend and how you can take advantage of their referral program.

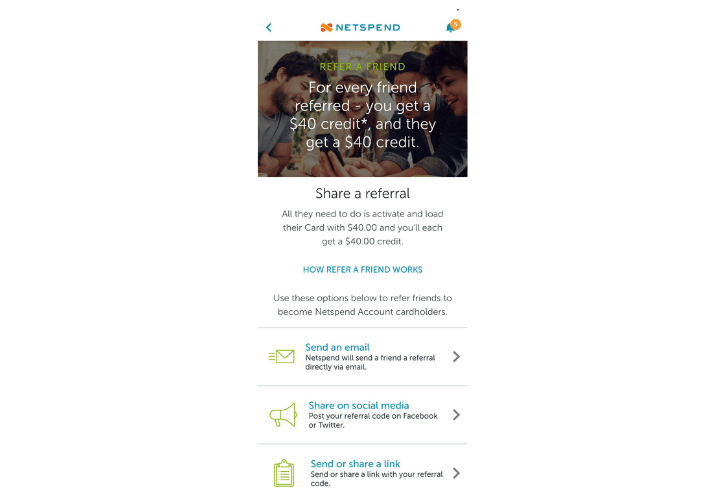

What is the $40 Netspend Referral Program?

The Netspend referral program gives you a $40 bonus when you sign up through a Netspend referral link and make your first deposit of $40 or more. Although the referral bonus value is lower than some platforms, it equally has a much lower requirement threshold. If you deposit $40 into your account, you’re getting an additional 50% in referral credit.

It’s worth noting that you will only get the $20 referral bonus on the first Netspend account that you open. If you decide to open the maximum five accounts, you won’t be able to claim the referral bonus after your first account.

Like other referral programs, you can use your own unique link to refer friends and family to the platform. You’ll earn $40 credit for every user that you refer to Netspend. If you’re using Netspend to build your emergency fund, this is a great way to maximize its value.

Aside from Netspend, also check out Chime Bank referral. Chime’s offering great promotions as well.

How to Sign up With a Netspend Referral Link

When you sign up to Netspend Bank, you’ll want to decide whether you want to open one or the maximum five accounts. If you choose to open five accounts, each one will be with a different company but still serviced by Netspend. The five prepaid debit cards that you can open through Netspend include:

- Netspend Prepaid Debit Card

- Western Union Prepaid Debit

- H-E-B Prepaid Debit Card

- Ace Elite Prepaid Debit Card

- Brinks Prepaid Debit Card/Netspend MLB Prepaid Debit Card

It’s easy to be overwhelmed when setting up your Netspend Bank account. While it will only take a few minutes, you want to set aside time to focus on each step. Ensuring that you follow each of these steps correctly will make sure that you’re able to open your Netspend Bank account, whether you choose to open one account or five.

1. Open a current or savings account with a traditional bank

Before you open your Netspend Bank prepaid debit card, you need to have another bank account. You’ll need to link your online account to your prepaid debit card. It’s worth checking how many accounts your current bank allows you to link to.

Some of the most popular banks, including Capital One, limit your linked external accounts to as little as 3. If you’re aiming to open 5 Netspend Bank accounts to maximize your interest gain, you may want to open another bank account to achieve this.

2. Set up your Netspend Bank account

When your online bank account is sorted, it’s time to sign up for your Netspend Bank account. The best way to do this is by using a Netspend referral link to get a $40 bonus when you deposit at least $40 into your account. When you use a referral link, make sure that our Netspend referral code: 2010048697 appears in the ‘referral code’ space in your sign-up form to ensure you get your $40 sign-up bonus.

3. Receive your prepaid debit card and activate it

Once you’ve signed up, you can expect to receive your prepaid debit card in the mail within a few days. When it arrives, you’ll also get the sort code and account number for your new account. You’ll want to keep this safe, and you’ll need to use it to link your other bank account to your new Netspend account.

When you activate your card, you’ll want to select the ‘pay as you go’ plan. This plan ensures that you’re not hit by any monthly fees. If you’re using Netspend Bank as a savings account, you’ll want to keep the prepaid debit card safe but not intend to use it.

4. Link your Netspend account to your bank account

Once your Netspend account is activated, you want to link it to your other current or savings account. Every bank account will be different, but you should be able to add an external account to your online profile.

Adding an external bank or payee allows you to make a transfer to your Netspend account without having to use the account number and sort code every time. If you want to save regularly, you can set up automated transfers to hit your savings goal.

5. Transfer money to your prepaid debit card

It’s time to transfer money from your current account to your prepaid debit card. You’ll be able to transfer money to your savings account once you have your prepaid debit card.

Once you’ve added the money to your account, go onto the Netspend app and select the ‘move money’ option in the sidebar before clicking ‘savings transfer’. This process will activate your savings account and allow you to start building your emergency fund.

6. Create an automatic transfer every 2 months to avoid inactivity fees

One thing you want to be aware of is Netspend Bank’s inactivity fees. It’s easy to think that you can leave your money in your savings account to start accumulating interest.

If you’re not using the prepaid debit card, the only fee to worry about is the inactivity fee. It’s charged any time that your account doesn’t have activity for 90 days. The easiest way to avoid this is to set up an automatic transfer every 2 months into your account. This transfer can be as low as $1 per transaction.

Is there a limit to how many people I can refer to NetSpend?

The good news is that there is no current limit to how many people you can refer to NetSpend’s referral program. You can refer as many people as you want and earn a referral bonus for each person who meets the eligibility requirements.

NetSpend understands that word of mouth is a powerful tool, and they want to encourage their members to share their positive experiences with others. Referring friends and family to NetSpend not only helps them discover the benefits of the service, but it can also help you earn some extra cash in the process.

However, it’s important to keep in mind that NetSpend does reserve the right to change the terms of the referral program at any time, including imposing limits on the number of referrals or the amount of referral bonuses. So, be sure to check the current terms of the referral program before you start referring multiple people.

How long does it take to receive the NetSpend referral bonus?

When you refer someone to NetSpend and they meet the eligibility requirements, both you and the new member will receive the NetSpend referral bonus. The time it takes for you to receive the referral bonus will depend on a few factors.

Typically, the NetSpend referral bonus will be credited to your NetSpend account within a few business days after the new member meets the eligibility requirements. However, this can vary depending on a few factors such as how quickly the new member meets the requirements and the processing time for the bonus.

To ensure that you receive your NetSpend referral bonus as quickly as possible, make sure that the new member you referred meets the eligibility requirements as soon as possible after opening their account. This includes activating their card and loading at least $40 onto it within 90 days of signing up.

If you haven’t received your NetSpend referral bonus within a few business days after the new member meets the eligibility requirements, don’t worry. You can always reach out to NetSpend’s customer service team for assistance. They’ll be able to look into the matter and help you receive your bonus as soon as possible.

What is Netspend Bank?

Netspend Bank is most popularly known for its prepaid debit cards and was launched in 1999. While a prepaid debit card isn’t for everyone, you can utilize the platform as a savings account.

Every Netspend Bank card gives you access to a savings account that is FDIC-insured with a 5% annual interest rate. The fact the account is FDIC-insured means that your money is handled the same as that from any FDIC-insured bank. So long as you’re not using the platform’s prepaid debit card, you’ll not be hit by any fees.

The best way to think of Netspend Bank is as a platform that offers two services. They have a prepaid debit card and a 5% interest savings account. Anyone looking to focus on their emergency fund or savings portfolio will want to skip the prepaid debit card. You can utilize the 5% interest savings account without using the prepaid debit card.

When you add money from your bank account to your prepaid debit card, it goes into the 5% interest savings account. In this sense, you want to look at the prepaid debit card as the link between your regular bank account and your savings account. With most emergency funds valued at over $1,000, Netspend Bank is a great way to set that money inside and earn interest to put towards your savings goal. Just like Netspend, Albert bank offers great rates too. Explore this Albert Bank review to find out.

Should you sign up for Netspend Bank?

Rising inflation is making it hard to maximize the potential of your savings accounts. Aside from getting a $40 Netspend sign up bonus, gone are the days when banks were committing to offer the best interest rates on their accounts. Netspend is one of the few banking accounts that offer 5% interest. You can also maximize your Netspend bonus by signing up with a Netspend referral link and get $40 for free.

Netspend Bank is an excellent way to add extra cash to your savings account. However, there is a catch to the 5% interest. This high-interest rate is only offered on the first $1,000 deposited into each account. Anything over the value of $1,000 will earn you a smaller interest of 0.5%. Comparatively, this lower rate is still relatively competitive for today’s financial interest.

If you want to maximize the interest you earn, you can open up to 5 Netspend accounts. If you add $1,000 to each of these accounts, you can earn 5% interest across all five, totaling $250 in interest. You could also maximize your savings potential by having your partner open a similar number of accounts. If you have 10 Netspend accounts in your household, you could earn $500 interest on $10,000 of savings.

If you aren’t convinced yet, read more info about Nestpend in this Netspend bank account review.

Final Thoughts – Is It Worth It?

Netspend Bank is ideal if you want to boost your savings account with a generous 5% interest rate. However, you’ll want to weigh up whether it’s right for you as the 5% interest only applies on the first $1,000 you save. If you have the time, you could open 5 accounts to save $5,000 with 5% interest. Although the Netspend referral program value is relatively low, it’s also easy to hit the $40 deposit threshold.

Are you also interested with Lili Bank? Read this Lili Bank referral guide and earn more bonuses.