M1 Finance vs tastytrade: Features, Investments, Fees, Pros & Cons

Here is a comparison of two popular robo-advisors: M1 Finance vs tastytrade. The high cost of hiring investment advisors has led to the proliferation of automated investing platforms. These platforms rely on computer algorithms to create advice based on users’ requirements.

In addition to lowering the cost of professional financial planning advice, these platforms, also known as robo-advisors, are efficient, accessible, and have low initial investment requirements. Some even require zero deposits.

Although some of the basics are the same across platforms, robo-advisors come in different shapes and sizes. For example, some cater to experienced investors while others devote their services to introducing newcomers to the investment world. As such, it’s important to define your goals before engaging with a robo-advisor.

Let’s begin comparing M1 Finance vs tastytrade.

What is M1 Finance?

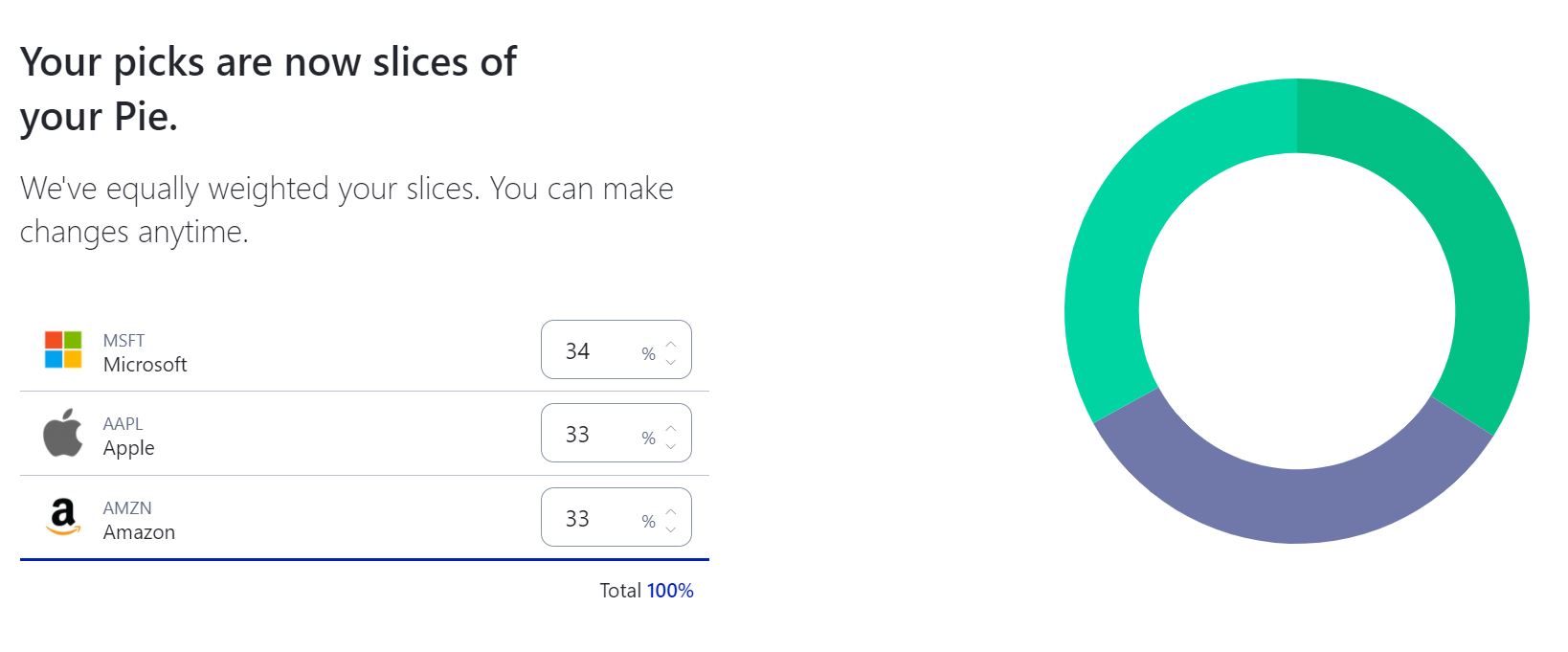

M1 Finance is a hybrid robo-advisor offering automated and self-directed investment options. Also, the platform has some qualities of a legacy brokerage firm. M1 powers its automation using pre-built but customizable templates known as “pies.”

Notably, the platform builds pies based on Modern Portfolio Theory, or MPT. At its heart, the theory allows investors to mitigate risks by not putting all their eggs in one basket. Additionally, MPT binds assets in a portfolio, enabling them to move as one unit.

Unfortunately, while MPT allows for questionnaire-based walkthroughs to help determine investors’ risk levels, M1 eliminates this functionality since the platform is meant for experienced investors. Our M1 Finance review will give you thorough information about M1 Finance.

What is tastytrade?

tastytrade is an automated financial advisor built for active options traders. Its tools work on volatility, probability, and liquidity. tastytrade’ main focus is on derivatives trading, although it also gives investors access to exchange-traded funds (ETFs), mutual funds, and stocks.

According to its CEO, the platform is for those who can remember options put faster than their “mom’s birthday.” The platform champions first learners who are ready to trade hard. To get you up to speed, tastytrade provides weekly videos that are later preserved in a library for convenient reference. Get more details about tastytrade from our tastytrade review.

Available Investments

M1 Finance

Bonds – M1 allows investors to interact with bonds. Bonds are considered to be securities with a lower risk rating. Unlike ordinary shares, interest on bonds is fixed. Different types of bonds include corporate, municipal, US savings, and US treasury

Exchange-traded funds (ETFs) – This type of investment features a group of stocks that allows you to invest as if they were a single asset.

Exchange-traded funds (ETFs) – This type of investment features a group of stocks that allows you to invest as if they were a single asset.

Mutual funds – M1 Finance states that investors can “invest in any” fund, including mutual funds.

tastytrade

Options – tastytrade is primarily meant for options trading. As such, its main tools are geared toward helping options traders get the most out of their investments.

Stocks – If options are not your thing, then consider investing in stocks.

Cryptocurrencies – tastytrade supports 13 virtual currencies. They include Bitcoin (BTC), Basic Attention Token (BAT), Bitcoin Cash (BCH), Polkadot (DOT), and Litecoin (LTC).

Futures – The robo-advisor supports various futures products, including the Small Exchange futures product, CME futures, and micro e-mini futures. tastytrade also supports options on futures.

Fees and Commissions Comparison

When it comes to fees, M1 ensures you get the best returns on your investments through feeless trading and account opening. But, apart from trading, there are some required fees. For instance, the platform transfers regulatory charges such as those imposed by the Securities and Exchange Commission (SEC) and FINRA’s Trading Activity Fee to users. While the fees are almost negligible, they can be a bump on your investment journey. Unfortunately, there’s no way to evade them.

Additionally, using an M1 Plus account costs $125 annually. Other charges include check requests, amendment repairs, ACH notice of correction, IRA termination, Computershare transfers, and rights exercise. On the other hand, tastytrade offers commission-free trading when interacting with stocks. Also, it doesn’t charge users to close options on stocks/futures and micro futures. Other free services include ACH deposits and withdrawals.

The free ride ends there. The platform charges $1 to open options on stock contract, $1.50 to open options on a micro futures contract, and $1.25 to open and close a futures contract. That’s not all. Cryptocurrency trades incur a one percent fee, while small futures and micro futures incur a $0.25 and $0.85 fee, respectively, to open or close a contract. Other charges include margin fees, restricted stock processing fees, overnight domestic/international check delivery, paper confirmation, clearing fees, and paper tax statements.

Features

M1 Finance

Cash management account – This feature is tied to M1 Spend and includes benefits such as FDIC insurance and a linked debit card.

M1 Borrow – M1 Finance allows investors to borrow against their portfolios. In addition to borrowing for personal use, the feature can be used for margin loans. The platform offers investors a loan of up to 35 percent of their portfolio’s value.

M1 Plus – M1 Plus is a subscription-based service that costs $125 per year. This rate gives you access to custodial accounts, discounted margin loans, five design choices for your debit card, and other perks.

Automated investing accounts – The robo-advisor allows investors to use pies to automate their investment choices.

Retirement accounts – These are specially made for those investing toward their retirement. The accounts can be conventional IRAs, SEP IRAs, or Roth IRAs. Note that M1 Finance IRAs require a minimum account balance of $500.

tastytrade

Accounts – tastytrade offers various accounts including trusts, retirement (traditional IRAs, Roth, and SEP IRAs), joint brokerage, and corporate accounts.

Intuitive mobile workflow – The platform provides an intuitive mobile application enabling you to stay on top of your trading game even when you are on the move.]

High-end technology – The robo-advisor employs trading technology created by the same professionals who brought options trading to retail realms.

Margin support – tastytrade allows investors to trade on margin if they open a margin individual account. Borrowed amounts are meant for equity trades since options are non-marginable. While opening a margin account is free, you’ll be required to maintain an account balance of $2,000 to enjoy all the perks that come with this account.

Referral Programs

On M1 Finance, inviting friends and family to the platform using the refer-a-friend option earns you and your invitee $50. Head on to our M1 Finance referral program article to read tips on how to get your $50 bonus successfully. You can get even higher payouts by inviting new users through the M1 Finance affiliate program. With the affiliate program, you instantly receive $100 when someone creates an account using your affiliate link and deposits at least $1,000.

tastytrade takes referrals a notch higher. The platform determines rewards based on the number of referrals you make. For example, two invitees earn you two referral credits worth $150 redeemable for a Google Home, while 750 referral credits earn you a Tesla Model S. Check out the tastytrade referral steps and other tastytrade referral rewards you may get in our tastytrade referral article.

Customer Service

M1 offers an FAQ section to answer customer questions. However, if your query isn’t listed here, you can reach the customer service desk via phone, email, or chatbot. tastytrade provides customer support through the phone and platform-based chat feature. If you’d like to speak to a customer service representative, the phone option is active from 7 a.m. to 5 p.m. Central Time from Monday through Friday.

Education and Research

M1 Finance keeps investors informed through frequently asked questions, a blog, social media, videos, and an email newsletter. However, the available education materials are meant to inform and not to advise.

On the other hand, tastytrade educates its users through video content, articles, and FAQs. Also, the platform offers research features aimed at assisting futures, options, and futures options traders in making educated decisions about their investments.

Pros and Cons

M1 Finance

| Pros | Cons |

|---|---|

|

|

tastytrade

| Pros | Cons |

|---|---|

|

|

Conclusion

From our M1 Finance vs tastytrade comparison, one thing is clear: don’t expect M1 Finance to hold your hand if you are a novice investor. Despite its enticing features like retirement accounts and opportunities to spend and borrow, the platform is only built for experienced investors.

Fortunately, tastytrade has your back if you are just dipping your toe into investing. However, although the platform offers a wide range of investment instruments, its main focus is on options trading.

Unfortunately, the M1 Finance vs tastytrade comparison lacks a clear overall winner. For experienced investors, M1 is an ideal choice while tastytrade is better for beginners.