$100 M1 Finance Referral + $100 Sign-up Bonus [May 2024]

M1 Finance Referral Program

To receive the M1 Finance referral bonus, sign up with this M1 referral link and deposit at least $100 in 30 days.

The M1 Finance referral bonus is a one-time sign-up bonus given to both existing and new users for each successful referral. You are eligible to receive a $100 M1 Finance referral bonus when you refer a friend or get referred to M1 Finance. To get the $100 M1 Finance referral bonus, you must open an individual or retirement account with an M1 Finance referral link and fund your account with $100 or $500 within 30 days of opening the account.

Note that you must keep the initial deposit in your account for 30 days. Additionally, M1 Finance does not deposit referral bonuses into a retirement account. If you opened a retirement account, you must also open an individual account to receive your M1 referral bonus.

| M1 Finance Referral Program | |

|---|---|

| 📜 M1 Finance Referral Link | M1 Finance Referral Link |

| 💰 Referring Gets | $100 |

| 🤑 Referred Gets | $100 |

| 💲 Redeem | $100 |

| 📆 Get Paid In | 1-2 Weeks |

What is the M1 Finance Referral Promotion?

The M1 Finance referral bonus is a sign up bonus given to both existing and new users of the M1 Finance platform for each successful referral. To receive the M1 Finance referral bonus, new users must open an account with a M1 Finance referral link and fund their account with $100 or $500 within 30 days. The amount of the initial deposit depends on the type of account that is opened. Individual accounts only need a $100 initial deposit, while retirement accounts need a $500 deposit. At the time of this writing, there are no limits on the number of friends you can refer to M1 Finance. Note, that M1 Finance changes the referral bonus amounts periodically. Previous M1 Finance bonuses were $10 and $30.

How to Get the $100 M1 Finance Referral Bonus?

Below are step-by-step instructions on how to get the $100 M1 Finance referral bonus.

Step 1: Use an M1 Finance Referral Link to open an individual or IRA account.

Step 2: If you opened an individual account, fund your account with $100 or more within 30 days.

Step 3: Skip this step if you opened an individual account. If you opened an IRA account, fund your account with $500 or more within 30 days. Another note about IRA accounts is that M1 Finance does not deposit referral bonuses into retirement accounts. You must also open an individual account to receive the referral bonus.

Step 4: Maintain your initial deposit in your account for at least 30 days. Removing your initial deposit before 30 days will void your referral bonus.

Where to Find your M1 Referral Link

You can find your M1 referral link in both the mobile app and the web browser. Follow these steps to find your unique M1 Finance referral link.

- Download the M1 Finance mobile app from the Apple or Google Play stores or log in to your account from a web browser.

- Tap the silhouette icon on the top right corner of the mobile screen or web browser.

- Click the Refer & Earn (this will only be visible if you have funded your account). You will find your unique M1 Finance referral link under Refer and earn.

M1 Finance Referral Terms and Conditions

- The M1 Referral offer is valid only for new brokerage or IRA accounts.

- To qualify for the bonus, you must make an initial deposit of $100 for individual accounts and $500 for IRA accounts within 30 days of signing up.

- Maintain your initial deposit must remain in the account for at least 30 days.

- You cannot combine this promotion with any other offer, including the M1 Finance transfer promotion.

- This promotion is not valid with any other offer.

- You must be a US resident or US citizen to qualify for this promotion.

Does the M1 Finance Referral Program Have Limits?

There is no limit on the number of referrals, and you will receive up to $50 for all successful M1 referrals. Invite as many friends and family members as you want to M1 Finance with your unique referral link. However, you cannot use your own referral link to refer yourself to M1 Finance. You can have up to five M1 Finance accounts under the same login, but only one account will receive the referral bonus. Additionally, you cannot combine the M1 Finance referral promotion cannot be combined with other M1 Finance sign-up promotions.

When Will You Get Your M1 Finance Referral Bonus?

You will receive your M1 Finance referral bonus within 14 days of opening a new account. Once the referral qualifications are met, you will see your $50 promotion under Settings > Promotions. You might see that the promotion was successful before M1 Finance applies the promotion to your Account. Note that you will only receive the M1 referral credit when you deposit at least $100 USD to your M1 Finance account. If you didn’t receive your referral credit, you can contact support and inquire about it. Note that you must not withdraw the initial deposit from your account for 30 days.

Did You Not Receive Your M1 Finance Bonus?

If you did not receive your referral promotion, it could be for several reasons. First, you may not have the right account type. To qualify for the M1 Finance referral promotion, you must open an individual or joint investing account. M1 Finance calls these accounts “Payment Accounts.” If you opened an IRA account, make sure also to open a Payment Account. Note that you do not need to fund these accounts to receive your referral credit. The second common reason for not receiving the referral promotion is not making the required initial deposit. As noted earlier, you must deposit at least $100 in an individual investment account and $500 in a retirement account to qualify for this promotion.

Does M1 Finance have a Free Stocks Sign up Bonus?

Many new stockbrokers are now offering free stocks as a sign-up bonus when you open a new account. As of July 2022, M1 Finance does not have free stocks sign-up bonus. The Give $50, Get $50 is the only M1 Finance sign-up promotion at the moment. However, if you are looking to receive free stocks, you may consider signing up for a new WeBull, Robinhood, or Tastyworks account.

Referral Programs Similar to M1 Finance

Driven by tremendous growth from zero-commission investing apps, more Americans are taking their financial future into their own hand. This trend has increased the competition for customer acquisition, and thus the marketing and referral expenditure of investment apps. While the higher cost of user acquisition may sound like a heavy expense for these companies, it’s a relatively inexpensive way for them to bring in more business (read our article on how M1 Finance makes profit). If you’re looking for other free cash referral programs, check out Tastyworks, Cash App, Robinhood, Acorns, and WeBull referral promotions. Also, check out our article on Ways to Make Money Online.

M1 Finance Sign up Promotions

As a new automated investing app in an already competitive stockbroker landscape, M1 Finance is investing quite a bit on new user acquisition with very generous promotions. Currently, M1 Finance has 3 active promotions:

M1 Finance $250-2,500 Transfer Promotion

You can earn up to $2,500 when you open a M1 Finance account and make a direct transfer from your current brokerage firm to M1 Finance. To receive this promotion, you must submit a transfer request on the M1 Finance website within 60 days of your sign-up date. The promotion amount depends on the amount of the transfer and it will be deposited to your account 90 days after the account transfer is received. More details about this promotion and the M1 Finance promo code can be found here.

M1 Finance Transfer Promotion

| Account Value | Promotional Credit |

|---|---|

| $100,000 – $249,999.99 | $250 |

| $250,000 – $499,999.99 | $500 |

| $500,000 – $999,999.99 | $1,000 |

| $1,000,000 - $1,999,999.99 | $2,500 |

| $2,000,000 + | $4,000 |

M1 Finance Deposit $1000, Get Up to $30 Promotion

M1 Finance offers another opportunity to receive a $30 sign up bonus when you open and fund your account with at least $1000. This sign up bonus may be worth it if you do not mind the higher initial deposit requirements ($1,000 instead of $100).

To get the $30 M1 Finance sign up bonus, you must open/fund an individual account with at least $1000. Please note that you must be a new M1 Finance user, never funded an M1 Finance account, or not opened an account with a M1 Finance referral link. M1 Finance will post $30 into your taxable M1 Finance account within 3-5 business days of meeting the promotion’s terms. Also, note you must keep the cash bonus in your account for at least 60 days from the date the cash reward is deposited into your M1 Finance account. This promotion cannot be combined with the M1 Finance referral or transfer promotions. The offer is effective March 1, 2021. More details about this promotion can be found here.

M1 Finance Give $50, Get $50 Referral Promotion

As noted above, the M1 Finance referral promotion is a one-time $50 bonus applied to a qualifying M1 Finance account when you sign-up with another user’s referral link. To receive this promotion, deposit at least $100 in an individual account and $500 in a retirement account within 30 days of opening an account. Additionally, you can earn more by sharing your M1 Finance referral link with friends and family.

M1 Finance Review

The single most popular trend in investing today is passive investing. Most people associate passive investing with low-cost, exchange traded funds (ETFs) such as those you can purchase at Vanguard. But can you be a passive investor with a customized strategy? With M1 Finance you can. In the remainder of this page, we present a short review of the M1 Finance Platform. For a more in-depth review about the M1 Finance app, visit our article M1 Finance Review or learn about 12 things that you can do with M1 Finance.

What is M1 Finance?

M1 Finance is a combination of a robo-advisor and a traditional brokerage. Like other robo-advisors, M1 presents several default themes known as “pies”, which have a default allocation between different securities. Unlike other robo-advisors, M1 Finance allows you to customize the allocation between different securities while keeping other great features such as the free re-balancing and trading.

What are M1 Finance Pies?

One way to invest in the stock market is by purchasing exchange traded funds (ETFs), which are a collection of tens, hundreds, or sometimes thousands of stocks or bonds in a single fund. ETFs are designed to perform well in most market conditions and can be held for an extended period of time. M1 Finance provides an opportunity to create your own ETFs with portfolio “pies”. Portfolio pies are easy to visualize as each investment is shown as a slice of pie. You can create your own pie or invest using expert pies made by financial professionals. Investing pies are a great way to explore your creativity in the stock market.

Put Your Investments on Autopilot

M1 Finance supports recurring transfers from your bank account to the M1 Finance account and automatic investing into your portfolio pies. With this feature, you can remove the emotion and nuisance of manual steps from investing. If you are looking for alternative auto investing apps, you may be interested in Cash App, a new peer-to-peer payment app that allows recurring investments in the stock market.

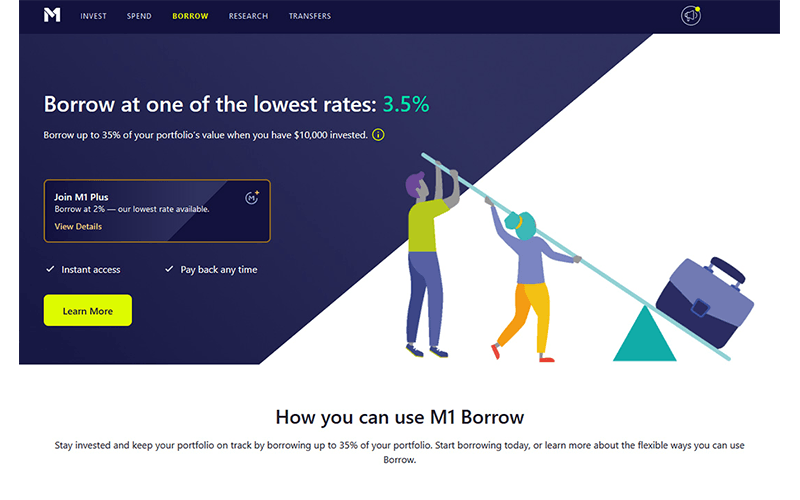

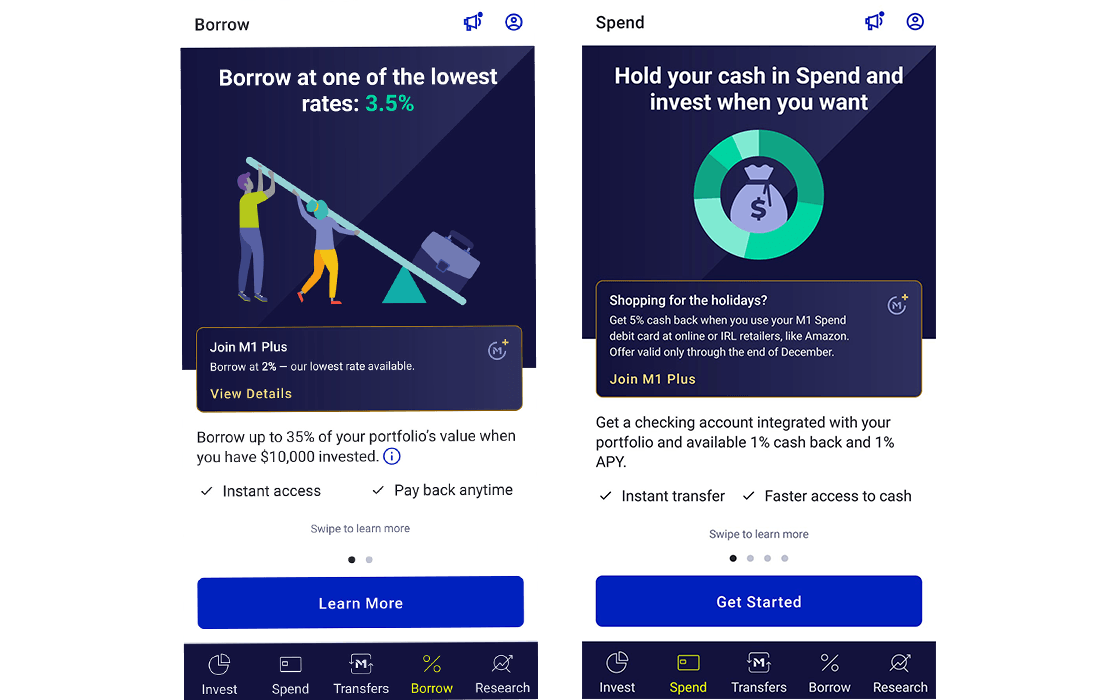

Take Out Low Interest Loans

Another unique feature of M1 Finance is the ability to take out a loan of up to 35% of your account balance without any credit check once your account balance reaches $10,000. With this feature, you can bypass traditional lending hurdles and get easier access to credit at a lower rate of 3.5% (2.00% if you are using M1 Plus).

M1 Finance Platforms

Web Platform

M1 Finance is a technology-first company with a smart investing platform. The M1 web application uses an integrated solution to automate investing. Also, the interface is easy to use, even for those new to investing. It has a combination of the tools for traditional online brokerage and the exemplary components of Robo-investing platforms. The web application incorporates investing, banking, and margin lending all together in one platform. The “pie investing” feature, which is unique about M1 Finance, shows your portfolio balance and allocation of investment assets. Furthermore, The M1 web platform also has an education center, with informative tabs to help you with your financial decision making. You can find your M1 Finance referral link in the profile tab of the web application.

Mobile Platform

Almost all of the features of the M1 Finance web platform can be found on the M1 mobile app. It is an intuitive easy to use app that can help you invest, borrow, and spend on the go. One of the best features of the app is the dashboard that shows your existing portfolio and balance as a pie. You can customize your portfolio in the app just like the web platform. However, based on our experience, it is easier to create and manage pies on the web platform. Lastly, you can share your M1 Finance portfolio with friends, family, or social media from within the app. The M1 Finance invitation link can be found in the profile tab of the mobile app.

M1 Finance Compared to Other Robo Advisors

A Robo-advisor is an algorithmically driven process for building you a diversified investment portfolio based on your answers to a few investing questions. Robo-advisors are built with the expertise of professional advisors, then automated through an algorithm. The result is expert advice, a diversified portfolio, and no hassle of waiting days or weeks to build a diversified portfolio. So, which Robo-advisor should you use, and why? In this section, we will compare some of the main features of M1 Finance with five other popular Robo-advisors (Betterment, Ellevest, Wealthfront, Bloom, and SoFi).

Fees and Commissions Comparison

M1 Finance has the lowest fees and commissions compared to other automated investing platforms. The only fees you might see is if you invest in an ETF, that ETF will have a small expense ratio (not charged by M1 Finance).

| Platform | Fees and Commissions |

|---|---|

| $0 fees and $0 commissions or markups on trades. No annual fees. |

| $0 fees for “Checking” plan, 0.25% of your account balance annually for the “Digital” plan, and 0.40% for the “Premium” plan. |

| The “Essential” plan at $1/month, “Plus” plan at $5/month and the “Executive” plan at $9/month. |

| An annual fee of 0.25% of your account balance, charged monthly. There are no other miscellaneous fees. |

| Bloom Essentials: $45 per year per account, Bloom Standard: $120 per year per account, and Bloom Unlimited: $250 per year per year with unlimited accounts. |

| $0 for accounts that have a balance below $10,000 and for SoFi borrowers. Otherwise, it’s 0.25% of your account balance per year. |

Account Minimum Comparison

While M1 Finance does not charge a fee for using its platform, it has a minimum balance for both individual ($100) and retirement ($500) accounts. Once the minimum balance is met, you can invest with as little as $10. Other platforms may have $0 account minimum for basic plans and may require a minimum balance depending on the portfolio.

Minimum Balance

| Platform | Minimum Balance |

|---|---|

| $100 minimum account size for taxable accounts and a $500 minimum for retirement accounts |

| $0 minimum for the “Checking” and “Digital” plan and $100,000 minimum balance for the “Premium” plan. |

| No requirement to maintain a minimum account balance. However, there are portfolio-specific minimums (ranging from $1 to approximately $240) |

| Minimum of $500 to invest |

| $0 |

| $0 |

M1 Finance Promotions Compared to Other Brokers

M1 has a generous referral program compared to its competitors. As noted above, the current M1 referral bonus amount is up to $50 for both referrers and referees. Additionally, you can earn up to $3,500 when you transfer your current investment portfolio from another broker to M1 Finance. The table below shows the current promotions for other Robo-advisors.

Promotions

| Platform | Promotions |

|---|---|

| Up to $3,500 transfer promotion and a $50 referral bonus for referring friends |

| 12 months of free service from Betterment with an initial deposit of at least $15,000 |

| “Two Months Free” promotional offer is offered to those who sign up for an Ellevest Membership service (Ellevest Essential, Ellevest Plus or Ellevest Executive) |

| Invite program: additional $5,000 managed for free for referrals |

| Occasional promotion codes for discounted annual fees |

| Earn up to $10k for referring friends to SoFi |

M1 Finance: The Most Customizable Robo Advisor

Modern investment companies are making it easier every day for consumers to start investing in the stock market, but not all platforms can be a match for your preferences. With M1 Finance you can benefit from having a simple finance account with borrowing, investing, and checking account options in one place. Below we have listed some of the benefits of using other robo advisors.

WHICH ROBO-ADVISOR IS BEST FOR YOU

| Platform | Best for |

|---|---|

| Any investor who wants automated investing in combination with a high level of customization tailored to a specific requirement and those wishing to pay zero account fees. |

| Beginner investors who don’t have much to get started but still have the convenience of a financial advisor |

| Investors who need help with an introduction to investing- get proper guidance with Ellevest’s educational materials. Also, women looking for a gender-based community whose goals are to provide a customized approach to investing |

| Those who already have a chunk of money available to invest, and those that want a truly digital financial advisor as needed |

| Anyone who has an employer-sponsored 401k, or an IRA account. Many 401k accounts have limited funds you can invest in and Blooom will make it easier to make the right investment decision |

| Those who wish to invest with any dollar amount and anyone who wishes to simplify their finances by having everything in one convenient location |

Is M1 Finance Safe?

M1 Finance is an innovative financial platform that offers a unique combination of automated investing and personal finance management. It provides users with a secure, automated experience and the ability to customize their investments with a wide range of options.

When it comes to security, M1 Finance takes great care to ensure user information and assets are safe. All user data is protected with 256-bit encryption and all user accounts are protected by two-factor authentication. In addition, all user activity is monitored, and M1 Finance will never share any personal or financial data with third parties. M1 Finance also offers a “safe harbor” for users’ investments. This means that even if the stock market drops, customers will be able to keep the value of their investments secure. M1 Finance also offers a portfolio protection feature, which allows users to limit their exposure to any specific security or sector.

Finally, M1 Finance is a member of the Securities Investor Protection Corporation (SIPC), which means that customer accounts are protected in the event of a brokerage failure. This provides an extra layer of protection for users’ investments. In short, M1 Finance is a secure and reliable financial platform that provides users with a range of features to help them manage their investments. The platform’s automated investing and portfolio protection features make it a great choice for those looking for a secure and convenient way to invest.

With all these, do you have questions like, “how does M1 make money?” Click here to find out how.

Is M1 Finance for everyone?

We like to think it’s best for advanced investors – those that have been in the market, know what they like and don’t like, and can choose their own investments. It’s a risk you take choosing your own allocations, but you may also use the prebuilt pies built by experts to start. The key is knowing what you’re saving for, what your timeline is, and how much risk you can take. Once you know that, M1 is a great way to invest, save money on fees (a lot of money), and enjoy someone else watching over your portfolio.

Used the link on this page and got $50. Took about a week after the initial deposit. Thanks.