Chime Bank vs Traditional Banks: Breaking the Mold

In recent years, the world of banking has undergone a notable transformation. Traditional banking, once synonymous with physical branches and paperwork, is now sharing the stage with a new player: digital banks. Chime Bank vs Traditional Banks reflects this shift, presenting users with a choice between the established brick-and-mortar institutions and the innovative and tech-driven approach of digital banking.

Chime, a leading figure in this digital banking wave, is challenging the status quo, shaking up how we view and manage our finances. With its user-friendly mobile app, transparent fee structure, and innovative features, Chime redefines the banking experience.

Advantages of Chime Bank

Fee Structure

Chime takes a refreshing approach to fees, ensuring users won’t encounter hidden charges or monthly maintenance fees. Notably, the absence of fees for overdraft protection sets it apart from traditional banks that often levy hefty charges for such services.

Accessibility

Chime embraces a mobile-centric model, offering users unparalleled convenience through its intuitive mobile app. However, it’s essential to note the trade-off – Chime lacks physical branches. While this digital approach aligns with modern preferences, users who value in-person banking experiences may find it different from the traditional bank setup.

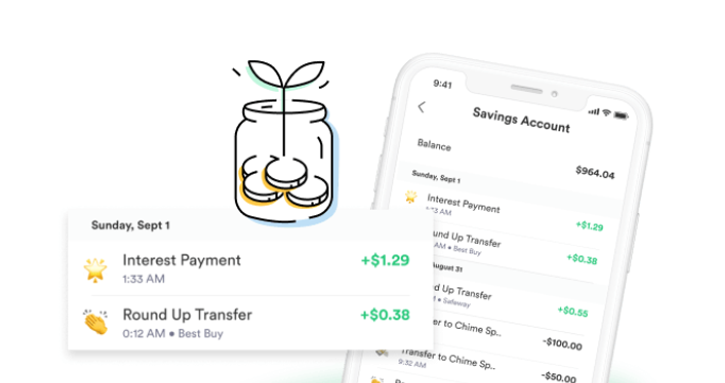

Technology

Chime’s commitment to user-friendly technology is evident in its mobile app features. The app provides a seamless experience, allowing users to manage transactions and their accounts effortlessly. Chime leverages cutting-edge technology to enhance the overall banking experience, catering to users who prioritize efficiency and innovation in their financial interactions.

Disadvantages of Chime Bank

Limited Physical Presence

Chime’s digital-first approach means no physical branches, which may disadvantage users who value face-to-face interactions. Traditional banks provide in-person services, making them more suitable for individuals who prefer the security and familiarity of brick-and-mortar locations.

Deposit Limitations

Chime imposes deposit limitations, which can pose challenges for users with large cash deposits. With their established infrastructure, traditional banks often have an advantage in handling substantial deposits. This limitation may impact users who regularly deal with significant amounts of cash and rely on a bank’s ability to manage larger transactions.

Advantages of Traditional Banks

Physical Presence

One notable advantage of traditional banks is their physical presence through brick-and-mortar branches. This accessibility is crucial for users who prefer in-person services and value establishing local banking relationships. Having a physical location to visit provides a sense of security and familiarity for those who prioritize face-to-face interactions with their financial institution.

Comprehensive Services

Traditional banks offer various financial products and services, ranging from mortgages and loans to diverse investment options. The comprehensive nature of their offerings makes them a one-stop solution for various financial needs. This breadth of services allows users to explore different aspects of their financial journey within the same institution, providing convenience and versatility.

Disadvantages of Traditional Banks

Fee Structures

Traditional banks often come with hidden fees and monthly maintenance charges that may catch users off guard. This fee structure contrasts with Chime Bank’s transparent approach, eliminating hidden charges and giving users a clearer understanding of their financial transactions. Additionally, traditional banks may impose fees for various services, contributing to a potentially higher user cost.

Technology

One significant drawback of traditional banks is their reliance on outdated technology. This can result in limitations and challenges, particularly regarding digital convenience and user experience. As technology advances, traditional banks may struggle to keep pace with the seamless and user-friendly features of digital banks like Chime. This technological lag could impact the efficiency and convenience that users have come to expect in the digital age.

Making the Switch

If you’re contemplating switching from a traditional bank to Chime Bank, there are several considerations to remember. First and foremost, assess your banking needs and preferences. Consider the fee structures, technology, and services offered by both options. Once you’ve decided to switch, the process is relatively straightforward.

To transition from a traditional bank to Chime Bank, follow these steps:

1. Open a Chime Account: Start by opening an account with Chime. The process is typically quick and can be done entirely online through their user-friendly platform.

2. Transfer Funds: If you have existing funds in your traditional bank account, transfer them to your new Chime account. This ensures that you have the necessary balance for your day-to-day transactions.

3. Update Direct Deposits: If you receive direct deposits, such as your salary, pension, or other income, update your account information with the relevant parties. This ensures that funds are directed to your Chime account.

4. Update Automatic Payments: If any automatic payments are linked to your traditional bank account, update the payment information to reflect your new Chime account details.

5. Close Your Traditional Bank Account: Once you’ve ensured a smooth transition of funds and payments, consider closing your traditional bank account. Be aware of any potential account closure fees and ensure all outstanding transactions are completed.

Chime bank vs Traditional Banking? Making the switch to Chime Bank offers a streamlined and user-friendly experience. With a focus on transparency, minimal fees, and advanced technology, Chime provides a banking alternative that aligns with the needs of today’s digital-savvy consumers. As you embrace the advantages of Chime, you’ll likely find a banking experience that is efficient and tailored to suit the demands of your modern lifestyle.