Binance Review: What Is Binance and Why Is It Top Rated?

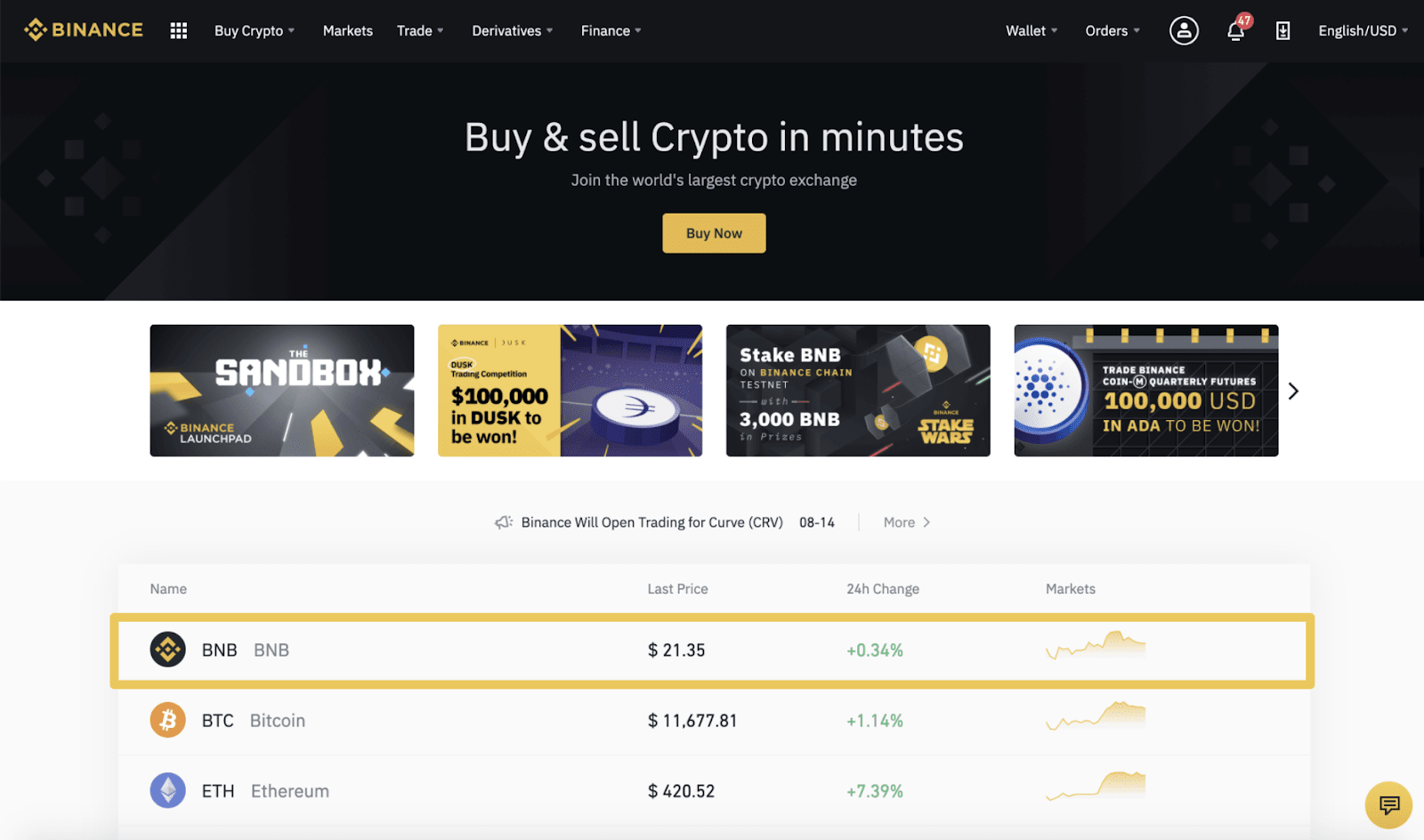

Binance is one of the top-rated cryptocurrency exchanges and supports the buying and selling of more than 200 crypto coins. Apart from its native currency, Binance Coin (BNB), the exchange supports the trading of major virtual currencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

Moreover, the trading platform makes users feel at home by providing tools to aid their decisions hence improving returns on investments. Crucial to any crypto exchange is the processing speed and security. Binance Exchange enhances users’ and system security through a merger of several computing architectures.

Additionally, Binance Exchange boasts of a high processing capacity of 1.4 million orders per second. The exchange is famous for its affordable transaction fees, sufficient liquidity threshold, and attractive discounts for using its BNB coin.

Creating an account on Binance Exchange

Before attempting to use the exchange, the initial step for any Binance user is signing up for a user account.

However, due to the popularity of Binance, you need extra caution to avoid phishing sites that mirror the Binance website. To be on the safe side, always confirm that the website address is Binance.com.

Signing Up for A Binance Account

With an active email address, an account sign-up process is possible. Here are the steps:

- Visit the official Binance.com website address. Once the website displays the landing page, click on the “Register” icon on the page’s top right side.

- Type your email address followed by your preferred password and press the “enter” or “okay” button on your device.

- Click on the “Agree” icon of the Terms and Conditions. This will take you to the final step where you need to solve a puzzle to confirm that you’re not a robot.

- Finally, check your email inbox for a link to verify your email address. Once you click on the verification link, your account becomes active.

What Can You Do with Binance?

Buying and selling crypto on Binance follows user-friendly procedures making it ideal for a beginner. The platform offers a stunning selection of a vast array of virtual coins for trading. However, the major currencies that trade in pairs are BTC, ETH, XRP BNB, and Tether.

Moreover, the platform still offers conversion services for cryptocurrency to fiat currency, which are available on “Binance fiat markets.” Users have the privilege of shifting between the basic, “classic,” and “advanced” interfaces depending on their experience level. Note that the advanced level has intimidating charting tools making it fit for experienced traders, while the basic level is simple enough for novices.

1. Spot Trading

Binance offers the “instant delivery” service when interacting with listed cryptocurrencies. The buying and selling process is settled “on the spot” with cash or virtual currency at the selected currencies’ current spot price.

2. Margin Trading

The Binance platform offers margin trading where traders can maximize their profits by borrowing from a third party. The borrowed capital leverages their financial position and creates the possibility of larger profit margins (amplified trading). Regular trading does not involve the borrowing of money.

However, Binance only offers margin trading for selected trading pairs. Surprisingly the leverage may rise to 100X on some currencies. Further, users can choose between a gross margin and an isolated margin. The former is quite risky, but the latter only limits possible trading losses to only one trading pair. Unfortunately, while higher leverage boosts the profits, it also amplifies the losses.

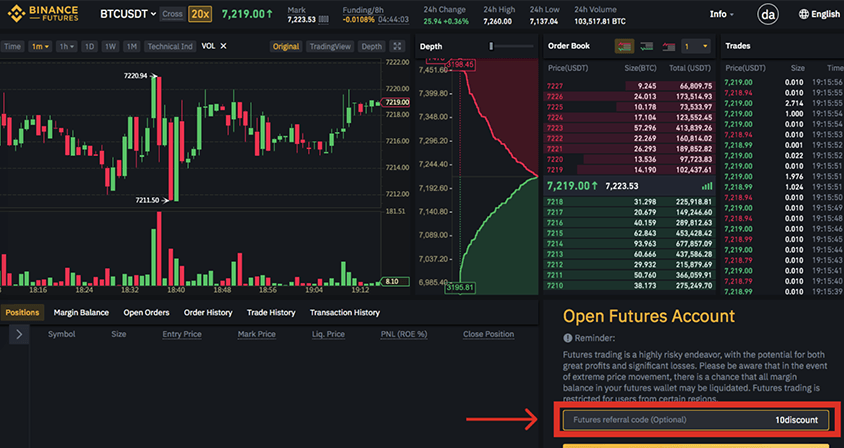

3. Binance Futures

Unlike spot trading, a futures market involves two parties (buyer and seller) who engage in a trading contract where the settlement is not instant but done on a future date at a liquidation position.

Binance Exchange offers futures for Bitcoin, Ethereum, and Bitcoin Cash. The maximum leverage is 125X,75X, and 75X, respectively. However, a user needs to create a Binance futures account on top of the ordinary Binance account to interact with futures on the platform. To access the offering, once you log in to your regular Binance account, you click on the “Derivatives” icon and then select “Futures” on the drop-down list. Next, click on the “open now” icon to activate the futures account.

The Binance futures platform helps traders project the market prices of popular coins like Bitcoin, Ethereum, and Litecoin. However, tether (USDT) provides collateral during trading and expresses the profits or losses incurred.

It’s important to note that the futures account balances are in a separate ledger from the regular trading account. You need not worry about the Binance futures’ interface because it’s a replica of the spot trading menu apart from few additional functions for adjusting leverage and surveying open positions.

How to Buy Crypto on Binance

The Binance exchange offers conversion services for fiat currency to a vast range of cryptocurrency coins.

Let’s explore the number of ways in which you can buy cryptocurrencies on the leading cryptocurrency trading platform.

Let’s explore the number of ways in which you can buy cryptocurrencies on the leading cryptocurrency trading platform.

1. P2P Trading

The P2P concept involves a peer-to-peer trading market where traders can trade in cryptocurrency against fiat currency. Also, its peer-to-peer (P2P) nature allows direct interaction between traders.

To avoid potential losses where one of the “peer” fails to honor their obligation, Binance has a P2P escrow service that protects traders in every buy-sell transaction. The service involves a secure and reliable third-party who temporarily holds the seller’s crypto after the buyer makes an order.

The escrow account holds the funds due to the buyer and only frees them after making the fiat payments to the seller. The Binance chat menu provides room for conversation between the trading parties.

In case there is a dispute, the messaging history can be relied upon in deciding against an appeal. Under normal circumstances, the seller frees the crypto after the buyer makes the payment. However, one of the parties may not meet their part of the bargain.

For instance, the buyer may fail to transfer the fiat currency, or the seller may fail to release the cryptocurrency even after the buyer has done his or her part. In that case, the aggrieved party needs to register an appeal by clicking on the “appeal” icon.

The escrow service which holds the cryptocurrency temporarily intervenes. If the seller is aggrieved, the escrow service reverses the crypto back to the seller. However, if the buyer is the aggrieved party, the escrow service sends the crypto to the buyer’s account but not before providing sufficient evidence.

2. Wire Transfer

Binance users can now purchase crypto directly with fiat currency via wire transfers. Luckily wire transfers involve no transaction fees. Unfortunately, wire transfers are unavailable for the widely-used US dollar. It’s only available for other major currencies like the Euro, CAD, and AUD.

3. Bank Cards

Binance recently established a working partnership with Simplex to act as a middleman in the purchase of crypto using credit and debit cards. Binance supports both Visa and MasterCard branded debit and credit cards. The credit or debit card option currently supports the purchase of top coins such as BTC, ETH, LTC, and XRP using fiat.

The fees are comparatively low, with only a charge of 3.5% per transaction. However, the cost is $10 if the 3.5% is below the $10 index. Furthermore, the transaction completion time of 10-30 minutes is impressive for a crypto exchange.

Other Services Exclusive to Binance Users

1. The DeFi Staking Service

There is a rise in the uptake of DeFi (decentralized finance) services. On behalf of its users, Binance stakes on selected DeFi protocols then channels the received earnings to users whose funds were used in the yield farming spree.

Through a few clicks, Binance users register for online earnings without the need to open and maintain a blockchain wallet. Since Binance surveys the trusted DeFi projects through active monitoring, its users can enjoy a cushion of security from the risks inherent in such projects.

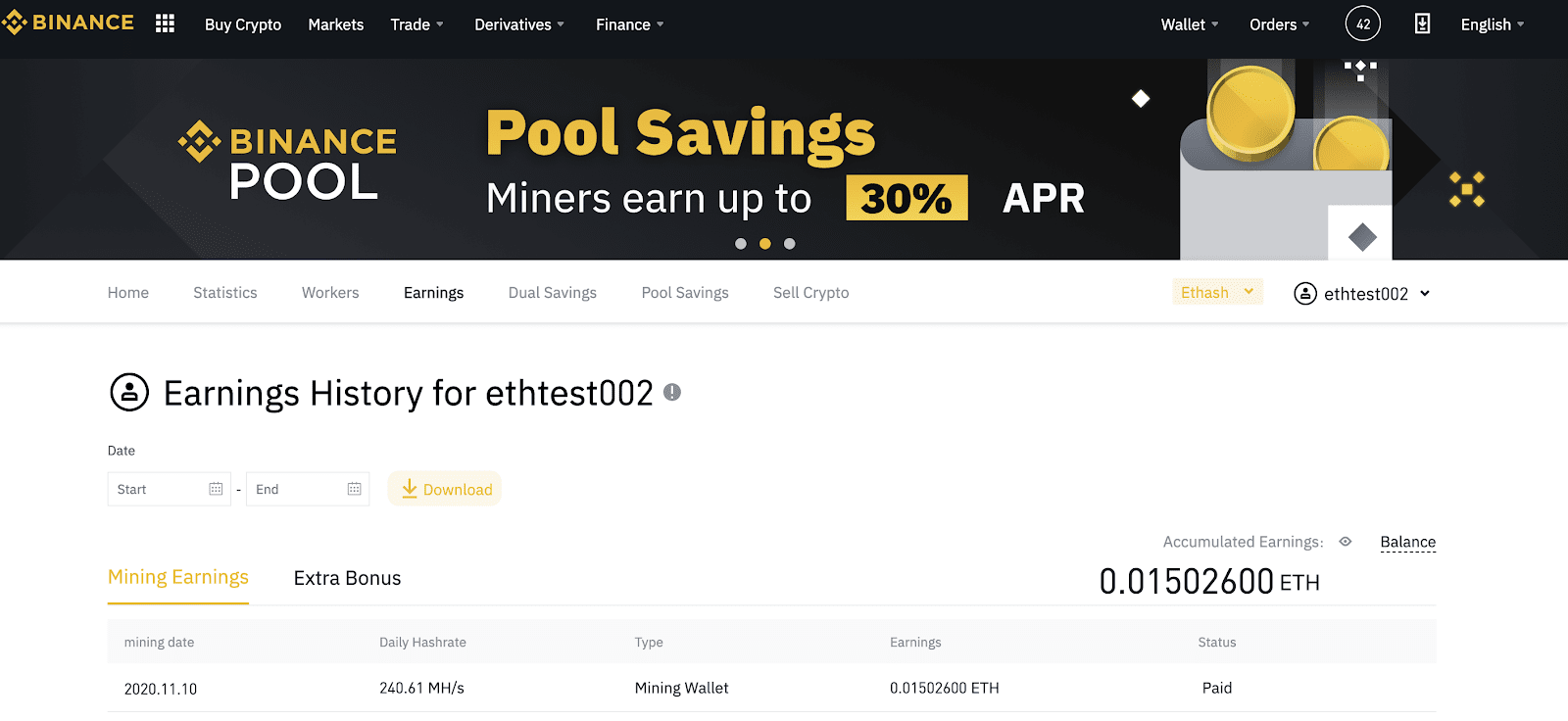

2. Binance Smart Pool

This service allows interested miners to join a bigger mining group. The pool subdivides the rewards from the mining process to each of the participants depending on the amount of hashing power contributed.

The collective mining resources (hash power) get automatically linked with the cryptocurrency that promises the highest returns per block.

3. Cryptocurrency Loans

The Binance platform also allows borrowing. The loans given to Binance account holders come in the form of USDT or BUSD. However, the collateral provided for the loans has to be in the form of BTC or ETH. The platform provides an easy route to get stable coins while ensuring exposure to your cryptocurrency deposits, thus helping users to avoid the charges incurred in selling crypto.

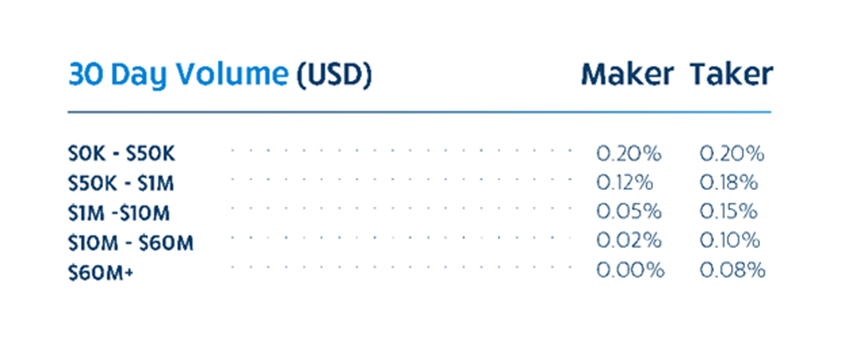

Binance Fees

Binance offers a competitive fee structure. For example, an impressive flat rate of 0.1% applies to users who are not in a rush to get instant settlement, also called market makers. The Binance future trading service has even more attractive fees; 0.02% for makers and a stunning 0.04% for takers (those who remove liquidity from the platform).

On scrutiny, Binance charges 0.2% less in fees as compared to other exchanges of its caliber. Though the variance is small, it’s significant when the trader deals with a huge order.

Moreover, operating with the Binance token (BNB) could attract an extra discount of up to 50% on trading costs. Fortunately, there are no charges on deposits apart from network costs. On the other hand, withdrawal fees apply, but they are perpetually updated to offer the fairest price index.

Binance Deposit and Withdrawal Limit

Binance has no limits on deposits but possesses a simple withdrawal limit structure. In a single day (24 hours), there is a withdrawal restriction of up 2BTC. However, this restriction applies to Level 1 verified account holders. Level 2 verified account holders carry more privilege. For instance, they can make withdrawals of up 200BTC in a single day (24 hours).

Additionally, authentication procedures entail filling in KYC forms and more documentation to verify your identity.

Binance Referrals

Binance offers a referral commission of up to 40% every time you invite a friend, and they trade on Binance. However, to earn referral rewards, you should forward a sign-up link to the targeted recruit. The referral link is unique to each user and helps track your referral activities on the platform. If you have not signed up for Binance yet, You can use the Binance Referral ID: F3MD0EBH to get back up to 10% on referral commissions from trading fees. Click here if you want to know more about Binance Referral.

Supported Countries and Currencies

Although Binance is a global platform, it’s not accessible to users in jurisdictions under US sanctions such as Iran and those under the radar of the United Nations Security Council.

Binance supports an impressive number of approximately 200 coins in its trading, buying, and withdrawing options. The major cryptocurrencies supported by Binance are; BTC, ETH, LTC, XRP, BCH, LINK, BNB, BUSD, BAT, ATOM, DASA, EOS, NANO, PAX, TRX, TUSD, USDT, and XLM.

Binance’s partnership with Simplex enhanced the exchange’s support of more fiat currencies such as the Nigerian naira, Korean won, and Swiss franc. Previously, the fiat ecosystem on the trading platform was dominated by the US dollar, the Japanese yen, and the Canadian dollar.

Comparing Binance with Other Exchanges

Binance overrides Coinbase Pro in terms of global coverage. The latter is available in only 103 countries, but the former is available worldwide. Additionally, Coinbase Pro’s trading fee is 2.5 times higher than Binance’s price.

The Bittrex exchange charges a flat maker/taker fee of 0.2% on all trades below $50K. However, Bittrex offers a broader choice of crypto coins.

Binance and Bitfinex charge similar fees to makers (0.1%), but Bitfinex charges 0.2% to takers, which is double what Binance charges.

Binance beats Kraken exchange on all fronts. With a 0.16% fee for makers and 0.26% for takers, Binance is cheaper. Moreover, Binance supports over 200 coins, with Kraken supporting only over 30.

Conclusion

The provision of margin trading is a crucial selling point for Binance since the prospect of higher profits attracts traders through leverage options.

Though Binance receives criticism for sluggish customer support and some technical issues, their currency support of over 200 crypto coins is an absolute plus. We should also not forget that their services are available worldwide as long as a country is not sanctioned by the US or UN.

Their good reputation in the crypto industry, complemented with favorable trading fees, are two pillars that might see them remain among the top in the industry in the foreseeable future.

If you need ideas about investing and want the convenience of a Robo-advisor, check out our M1 Finance Review.