MoneyLion vs Dave: A Comprehensive Comparison

In today’s digital era, the advent of banking apps has revolutionized the way we manage our finances. With MoneyLion vs Dave, two prominent banking apps that have garnered significant attention in the market, understanding their similarities and differences becomes paramount.

MoneyLion provides a diverse range of services, including checking and savings accounts, investment options, credit-building tools, personalized financial advice, and access to low-interest loans. Conversely, Dave focuses primarily on low-cost checking accounts, budgeting tools, automatic expense tracking, and the ability to access small cash advances prior to the next payday. By undertaking a thorough comparison of MoneyLion vs Dave in terms of features, fees, security measures, referral program, and user experience, we can gain comprehensive insights into the strengths and weaknesses of each app. This analysis will serve as an invaluable resource for readers to select the banking app that best suits their individual financial needs.

Comparing Features: MoneyLion vs Dave

When it comes to banking apps, the features they offer play a significant role in shaping the overall user experience. In this section, we will conduct a comprehensive comparison of the features provided by MoneyLion and Dave, two popular banking apps that have gained substantial attention in the market.

MoneyLion sets itself apart by providing a comprehensive suite of services designed to cater to various aspects of personal finance. One of its key features is the availability of checking and savings accounts, allowing users to conveniently manage their day-to-day transactions and savings goals within a single app. MoneyLion also offers investment options, empowering users to grow their wealth through different investment vehicles such as stocks and ETFs. Additionally, MoneyLion includes credit-building tools that assist users in improving their credit scores over time. This feature is particularly beneficial for individuals looking to establish or rebuild their credit history. Furthermore, MoneyLion provides personalized financial advice based on users’ financial profiles, helping them make informed decisions and achieve their financial goals. Lastly, MoneyLion offers access to low-interest loans, enabling users to borrow funds at favorable rates when needed.

In contrast, Dave takes a more streamlined approach with a focus on specific features that facilitate efficient money management. A notable feature offered by Dave is its low-cost checking account. This account allows users to handle their day-to-day financial activities, such as making payments and receiving direct deposits, with minimal fees. Dave also provides budgeting tools that assist users in tracking their expenses and creating customized budgets to promote responsible spending habits. Automatic expense tracking is another noteworthy feature of Dave, enabling users to effortlessly monitor their spending patterns and identify areas where they can save. Additionally, Dave offers the option to advance small cash amounts before the next payday, providing a convenient solution for individuals who may face short-term financial constraints.

Comparing Pricing: MoneyLion vs Dave

When evaluating banking apps, understanding the pricing structure and associated fees is crucial in determining their suitability for our financial needs.

MoneyLion utilizes a membership-based model that offers users a choice between a free account and a premium membership. The free account provides access to basic banking features such as checking and savings accounts, as well as limited access to certain services. On the other hand, the premium membership comes with a monthly fee and offers additional benefits, including enhanced rewards, credit monitoring, and financial advisory services. It is important for users to carefully evaluate the benefits provided by the premium membership to determine if the added features justify the monthly cost. Additionally, MoneyLion charges fees for specific services such as cash advances, which users should consider when assessing the overall cost of using the app. For more information you can take a look at MoneyLion’s pricing structure here.

In contrast, Dave follows a different pricing approach. The app offers a basic account with no monthly fees, making it an attractive option for users seeking a no-frills banking experience. However, it is worth noting that Dave charges fees for certain services. For example, expedited transfers or accessing funds from out-of-network ATMs may incur fees. While the absence of monthly fees is advantageous, users should consider their specific banking needs and usage patterns to assess whether the potential fees associated with specific services align with their requirements.

Comparing Security: MoneyLion vs Dave

Ensuring the security of personal and financial information is of utmost importance when choosing a banking app. By evaluating their security features and protocols, you can select the app that provides robust protection for your sensitive data.

MoneyLion employs industry-standard security measures to safeguard user information. This includes utilizing encryption technology to protect data transmitted between the app and its servers, ensuring that sensitive details such as account credentials and financial transactions are encrypted and secure. Additionally, MoneyLion implements multi-factor authentication, requiring users to verify their identities through multiple methods, such as a password and a unique code sent to their registered devices. This added layer of authentication helps prevent unauthorized access to accounts.

Furthermore, MoneyLion offers features that empower users to maintain control over their accounts’ security. For example, users can instantly lock their MoneyLion cards through the app if they suspect any fraudulent activity. MoneyLion also provides alerts and notifications to keep users informed about account activity, helping detect and report any suspicious transactions promptly. By actively involving users in monitoring their accounts’ security, MoneyLion enhances the overall protection of user data.

Similarly, Dave prioritizes the security of its users’ information by implementing robust measures. The app utilizes encryption technology to safeguard data transmission, ensuring that sensitive information remains encrypted and protected during communication. Dave also employs industry-standard security protocols to prevent unauthorized access to user accounts.

To provide an added layer of security, Dave offers optional security features such as biometric authentication (e.g., fingerprint or face recognition) for account access. This biometric authentication provides an extra level of protection against unauthorized access, as it requires the unique biometric data of the user to gain entry to the app. Additionally, Dave allows users to enable push notifications for account activities, such as transactions or changes in account settings, providing real-time alerts that help identify any suspicious activity promptly.

Both MoneyLion and Dave maintain stringent privacy policies and adhere to legal and regulatory requirements to protect user data. It is important to review and understand these policies to ensure that personal and financial information remains secure.

Comparing User Experience: MoneyLion vs Dave

A seamless and user-friendly interface is essential for a positive banking app experience. By evaluating their interfaces, navigation, customer support, and overall user satisfaction, you can be sure to select the app that is tailored to your needs.

MoneyLion boasts an intuitive and visually appealing interface that enhances the overall user experience. The app’s design focuses on easy navigation, allowing users to effortlessly access various features and functions. The dashboard provides a consolidated view of accounts, transactions, and financial goals, providing users with a comprehensive snapshot of their financial status. Additionally, MoneyLion offers seamless integration between its app and website, ensuring consistent functionality across multiple platforms. This enables users to access and manage their accounts with ease, regardless of their preferred device.

Moreover, MoneyLion offers robust customer support through email and chat services. Users can reach out to customer support representatives for assistance with account-related inquiries, technical issues, or general questions. The prompt and reliable customer support enhances the user experience by addressing any concerns promptly, ensuring a smooth banking experience.

Similarly, Dave offers a user-friendly interface that prioritizes simplicity and ease of use. The app’s design focuses on providing a straightforward and streamlined experience for users. With intuitive navigation and clear categorization of features, users can easily access essential functions such as checking balances, making transactions, and setting budgets. Dave’s emphasis on simplicity resonates well with users seeking a hassle-free banking experience.

Dave also offers customer support services to assist users when needed. Users can contact the support team through email or chat for inquiries or assistance with app-related matters. While Dave’s customer support is reliable, response times may vary depending on the volume of requests.

Overall, both MoneyLion and Dave prioritize user experience by offering intuitive interfaces and seamless functionality. Whether it is MoneyLion’s visually appealing design and comprehensive dashboard or Dave’s simplicity and ease of use, both apps strive to provide a positive user experience. Additionally, the availability of customer support channels ensures that users can seek assistance whenever required.

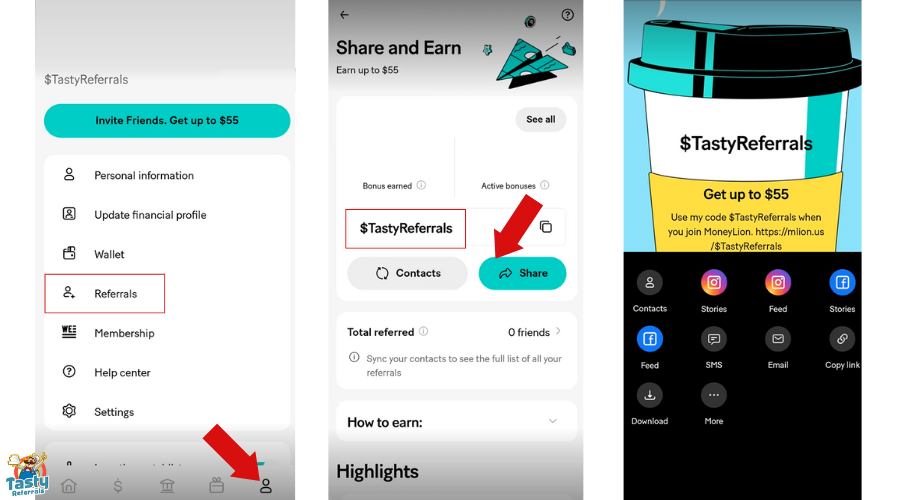

Comparing Referral Programs: MoneyLion vs Dave

Referral programs have become a popular feature of banking apps, offering users enticing incentives to invite others to join. In this section, we will conduct a comprehensive comparison of the referral programs offered by MoneyLion and Dave, focusing on the structure, benefits, and earning potential.

The MoneyLion referral program offers an attractive opportunity for users to earn rewards. New users who sign up with MoneyLion using a Money Lion referral code can receive up to $130 in free cash by completing various tasks, including a $10 referral bonus, a $50 direct deposit bonus, and a $10 crypto welcome bonus. Additionally, users can earn an additional $60 for each successful referral, where their referred friend opens and funds an account. MoneyLion’s referral program has no money transfer or deposit requirements, making it accessible to a wider range of users.

On the other hand, the Dave referral program provides a straightforward and rewarding experience. When a user signs up with a Dave referral link, they can earn a sign-up bonus of $15. Furthermore, for every friend referred (up to 5 friends) who takes an advance, the user receives $15, with a maximum earning potential of $75. Additionally, the referred friend receives a $15 welcome gift from Dave. To qualify for the rewards, users simply need to open a Dave Spending account.

While MoneyLion’s referral program offers a more extensive range of rewards, including bonuses for direct deposits and crypto-related tasks, Dave’s program stands out with its simplicity and straightforwardness. Users can earn rewards for each successful referral and provide their referred friends with a welcome gift to Dave. When choosing the right app for you, you should evaluate the potential earnings, ease of participation, and any specific requirements associated with each program.

Final Thoughts on MoneyLion vs Dave

MoneyLion and Dave present users with distinct options for managing their finances. MoneyLion offers a comprehensive suite of services, including checking and savings accounts, investment options, credit-building tools, and personalized financial advice. Their membership-based pricing model, with a free account and premium membership, caters to users with varying needs. On the other hand, Dave focuses on providing low-cost checking accounts, budgeting tools, automatic expense tracking, and the convenience of small cash advances. With no monthly fees for its basic account, Dave offers a straightforward and cost-effective banking solution.

Both MoneyLion and Dave prioritize security measures to protect user information, employing encryption technology and multi-factor authentication. User experience is also a key consideration for both apps, with intuitive interfaces, seamless navigation, and customer support services. Additionally, their referral programs provide opportunities for users to earn rewards by inviting others to join the app.

Ultimately, the choice between MoneyLion and Dave depends on individual preferences and specific financial goals. Users seeking a comprehensive suite of services and a customizable membership plan may find MoneyLion more appealing. On the other hand, individuals looking for a straightforward, low-cost banking experience may gravitate towards Dave. By carefully considering the features, pricing, security, user experience, and referral programs, users can make an informed decision and select the banking app that best aligns with their needs and priorities.