MoneyLion vs Chime: Which Banking App is Better in 2025?

In recent years, the fintech industry has experienced tremendous growth, with mobile banking apps like Chime and MoneyLion emerging as frontrunners in the race to revolutionize personal finance. These innovative platforms have transformed the way users manage their finances by providing a seamless, convenient, and user-friendly experience, accessible from the palm of their hands.

Whether you’re seeking a modern, all-inclusive banking experience or a more focused approach to managing your finances, Chime and MoneyLion have features and offerings tailored to a wide range of financial needs. By understanding the advantages and limitations of each platform, you can confidently select the app that will best support your journey towards financial success in 2023 and beyond.

In this article, we aim to provide a comprehensive comparison, MoneyLion vs Chime, examining the features, benefits, and unique offerings of each app to help you determine the best fit for your financial needs.

Chime Overview

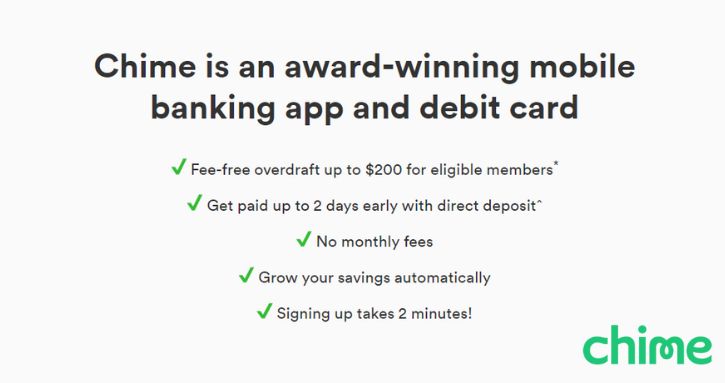

Chime, founded in 2013 by Chris Britt and Ryan King, has quickly risen to prominence as a leading mobile banking app offering fee-free checking and savings accounts. The platform was designed to challenge traditional banking models by providing a more user-centric experience without hidden fees and charges. Chime’s popularity has soared in recent years, with millions of users benefiting from its innovative features and easy-to-use interface.

At the core of Chime’s offerings are its fee-free checking and savings accounts, which eliminate the need for minimum balances and monthly maintenance fees. The platform’s automatic savings feature allows users to effortlessly build their savings by rounding up their purchases to the nearest dollar and transferring the difference to their savings account. Chime also enables users to receive their paychecks up to two days early through its early direct deposit feature, providing greater financial flexibility and convenience.

Chime offers instant transaction notifications, ensuring that users are always informed about their account activity and can promptly address any potential issues. Additionally, Chime provides a Visa debit card that can be used for fee-free transactions at more than 60,000 ATMs nationwide, allowing users to access their funds without incurring additional charges.

Chime’s rapid growth and widespread adoption can be attributed to its commitment to simplicity, transparency, and customer-centric approach. By eliminating the pain points associated with traditional banking, Chime has become a popular choice for those seeking a more streamlined and modern banking experience.

MoneyLion Overview

MoneyLion, founded in 2013 by Diwakar Choubey, Dee Choubey, and Chee Mun Foong, has emerged as a prominent and comprehensive financial app, providing a plethora of services to cater to a diverse range of financial needs. The platform has gained significant popularity in recent years, thanks to its versatile offerings, user-friendly interface, and commitment to helping users achieve financial wellness.

MoneyLion’s extensive range of services includes mobile banking, investment accounts, credit builder loans, and much more. Its RoarMoney account, which features a Mastercard debit card, allows users to access their funds at over 55,000 fee-free ATMs, making it easy to manage their money on-the-go. The app’s standout features, such as its cashback rewards program, early direct deposit, and personalized financial advice, have contributed to its widespread appeal among users.

One of MoneyLion’s most noteworthy offerings is its credit builder loans, which enable users to improve their credit scores by borrowing and repaying loans in a responsible manner. Additionally, MoneyLion’s investment account allows users to access various investment options, including individual stocks, exchange-traded funds (ETFs), and managed portfolios, catering to both novice and experienced investors.

The platform’s rapid growth and popularity can be attributed to its comprehensive suite of financial services and its commitment to helping users take control of their financial lives. By offering a one-stop-shop for banking, investing, and credit building, MoneyLion has become an attractive choice for users seeking an all-inclusive and convenient financial solution.

MoneyLion vs Chime: Features Comparison

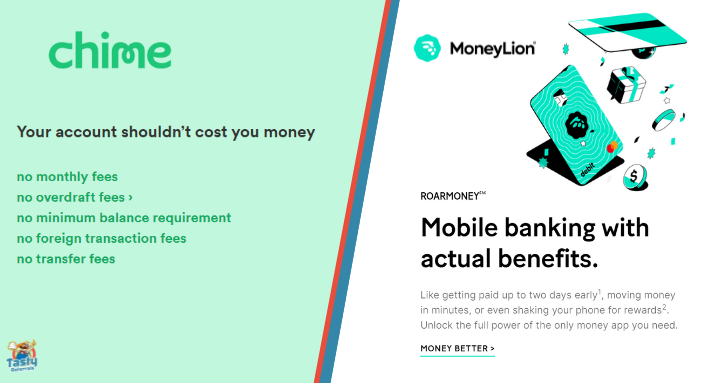

Fees: Chime offers a user-friendly online checking account with no monthly fees, emphasizing accessibility for everyone. Chime’s checking account comes with no minimum balance fees and no monthly fees. Additionally, Chime takes a different approach to overdrafts, allowing qualifying users to overdraft on debit card purchases with no fees through its SpotMe® feature. Chime also boasts an impressive network of 60,000+ fee-free ATMs at popular stores such as Walgreens, CVS, 7-Eleven, and Circle K. When you open a Chime Checking Account, you receive a Visa Debit Card that can be used anywhere Visa debit cards are accepted, with free debit card replacement offered.

MoneyLion’s fee structure offers transparency and flexibility with a variety of charges for different services. When using MoneyLion, you can expect a monthly administrative fee of $1. For ATM withdrawals, there is no fee if you use an in-network ATM, which is available at 55,000 locations. However, if you use an out-of-network ATM, there will be a $2.50 fee. When funding your account via an external debit card, a fee of 2.5% of the transaction amount applies. For foreign transactions, there is a 3% fee based on the transaction amount. International ATM withdrawals have a fee of $2.50. If you require expedited shipping for a replacement physical card, the fee is $25, and the card typically arrives within 2-3 business days. When it comes to bill payment, there is no fee for electronic payments, but a fee of $2.50 is charged for payments made by paper check. These fee details provide transparency and help you make informed decisions when managing your financial transactions through MoneyLion.

MoneyLion vs Chime: In summary, they offer various fee-free services, with Chime focusing on simplicity and no monthly fees for its checking account. MoneyLion provides a more customizable experience with its a la carte approach, allowing users to choose the services they need and only pay for what they use.

Direct Deposit: MoneyLion’s RoarMoney account offers faster direct deposits, giving users more control over their financial lives. By signing up for RoarMoney, you can receive your paycheck or other eligible recurring checks—such as unemployment, benefits checks, pension, or alimony—up to two days earlier than traditional banks. Setting up direct deposits with RoarMoney also unlocks Instacash advances equal to a percentage of your deposit amounts, up to $250. The percentage you unlock will be double what someone without a RoarMoney account would unlock with the same deposit amount, rewarding you for connecting direct deposits.

Chime, on the other hand, focuses on providing financial peace of mind to its users through features like early paycheck access, overdraft support, and credit history improvement. The first step to unlocking these features is setting up direct deposit with Chime. With Chime’s direct deposit, you can also get paid up to two days earlier than with traditional banks. As soon as Chime receives your paycheck, the funds become available to you.

Both MoneyLion and Chime offer the convenience of receiving your paycheck up to two days early through their direct deposit features. While Chime focuses on providing overall financial peace of mind, MoneyLion’s RoarMoney account adds additional perks like Instacash advances and higher unlocked percentages for users who set up direct deposits.

Savings Accounts: Chime and MoneyLion both offer solutions for users looking to grow their savings, but they take different approaches in helping their users achieve this goal.

Chime offers a high-yield savings account with an impressive annual percentage yield (APY) that surpasses traditional banks. One of the standout features of Chime’s savings account is the automatic savings feature, which allows users to save money effortlessly. Users can enable a round-up feature that rounds up their debit card transactions to the nearest dollar and transfers the difference to their savings account. Additionally, Chime users can set up an automatic transfer of a percentage of their direct deposit into their savings account, making it easy to build their savings consistently.

On the other hand, MoneyLion provides users with an investment account designed to help them grow their savings through investing in a diversified portfolio. MoneyLion’s investment account caters to both beginners and experienced investors, offering a range of investment options, including stocks, exchange-traded funds (ETFs), and thematic portfolios. Users can create a customized investment plan based on their financial goals, risk tolerance, and time horizon. By investing in a diversified portfolio, MoneyLion users have the potential to achieve higher returns compared to traditional savings accounts.

Both platforms cater to different financial needs and goals, allowing users to choose the savings approach that best suits their individual preferences.

Rewards: MoneyLion has an attractive cashback rewards program that allows users to earn cashback on a wide range of everyday purchases. By banking with MoneyLion, users can get rewarded for shopping at their favorite merchants and maximize the value of every dollar spent. Additionally, MoneyLion’s Shake ‘N Bank feature and Round-Ups make it even more convenient to earn rewards and effortlessly invest money. The fully managed investment account offered by MoneyLion further adds to the potential for financial growth.

In contrast, Chime Bank does not have a traditional cashback rewards program. Instead, Chime offers exclusive cashback deals called “Chime Offers” for its users. These offers provide special discounts and cashback opportunities from selected merchants when users make purchases using their Chime debit card. Chime Offers are updated periodically and can be found within the Chime app or on their website. It’s essential to keep in mind that these offers may come with specific terms and conditions, so users should review the details of each offer before making a purchase.

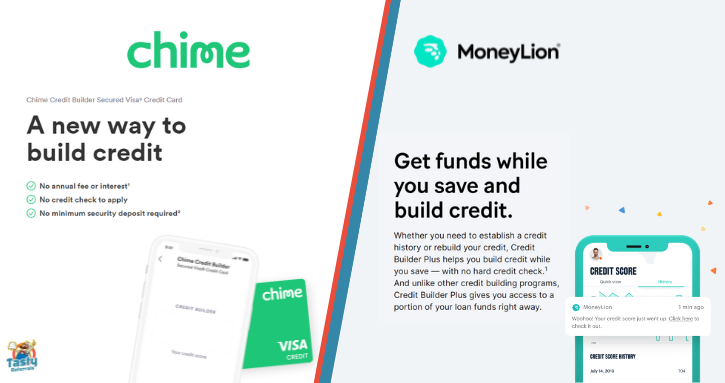

Credit Building: When it comes to credit building, Chime and MoneyLion offer different solutions to help users improve their credit scores.

Chime offers a Credit Builder credit card that allows users to build their credit without annual fees, interest charges, large security deposits, or a credit check to apply. The Chime Credit Builder card can be used anywhere Visa cards are accepted, making it suitable for everyday purchases like gas, groceries, and streaming services. To use the card, users must fund their Credit Builder account, which helps them maintain a budget by limiting their spending to the amount available in the account. By using the card for purchases and paying off the balance each month, Chime users can start building a positive credit history.

MoneyLion, on the other hand, provides a Credit Builder Plus membership that includes a loan designed to help users establish a 12-month payment history with all three credit bureaus. With 24/7 credit monitoring and 0% APR cash advances, MoneyLion allows users to track their progress and cover expenses while building credit and saving money. Unlike most credit builder loans that don’t offer any upfront funds, MoneyLion gives users access to a portion of their loan funds right away. To apply, MoneyLion conducts a soft credit pull that does not impact the user’s credit score.

In summary, Chime focuses on helping users build credit through a credit builder credit card that promotes responsible spending and timely payments. MoneyLion, on the other hand, offers a more comprehensive credit building solution through a Credit Builder Plus membership that includes a credit builder loan, credit monitoring, and 0% APR cash advances. Both banking apps provide unique approaches to credit building, catering to different needs and preferences.

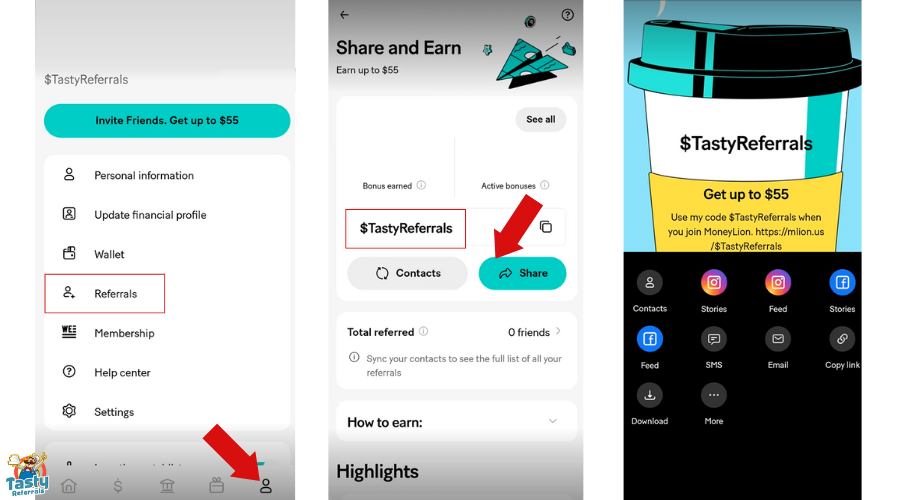

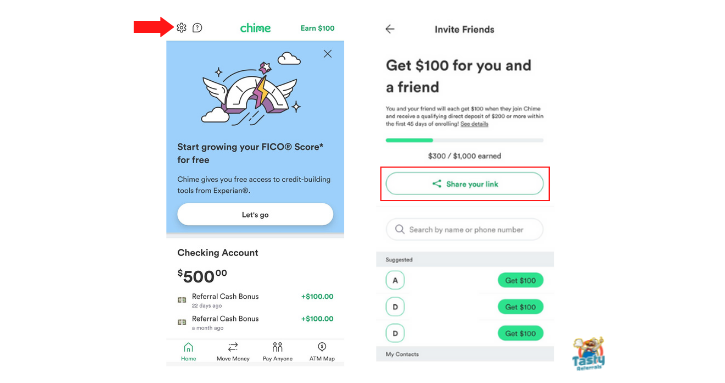

Referral Program: When it comes to referral programs, Chime and MoneyLion offer enticing opportunities to earn bonus cash. Let’s delve into the details of each program.

MoneyLion’s referral program allows you to earn a minimum of $120 in bonus cash. By opening a RoarMoney account using a MoneyLion referral, you’ll receive a $10 sign-up bonus. Furthermore, if you set up and receive a qualifying direct deposit of at least $100 within 60 days of opening your account, you’ll earn a $50 direct deposit bonus. Additionally, for each friend you refer who opens a new account, you can earn a $60 referral bonus.

Chime also offers a referral program that rewards both new and existing users. New users who open a checking account using a Chime referral link and set up a direct deposit of at least $200 within 45 days can receive a $100 bonus. The direct deposit can come from various sources, such as a payroll provider, gig instant payout, or government benefits. Moreover, existing Chime users will also receive a $100 bonus once their referred friends fulfill the required steps.

Both Chime and MoneyLion provide attractive referral programs, giving you the opportunity to earn extra cash. Whether you choose to participate in MoneyLion’s program, potentially earning $120 in bonus cash, or opt for Chime’s program with its $100 referral bonus, referring friends can be a rewarding experience on either platform. Just remember to review the terms and conditions of each referral program to ensure eligibility and make the most of your earning potential.

Customer Support: In the world of mobile banking apps, customer support is essential for ensuring a seamless user experience. Both Chime and MoneyLion recognize the importance of providing responsive and accessible support to their users.

Chime offers customer support primarily through email and a comprehensive help center available on their website and app. The help center covers a wide range of topics, including account setup, direct deposit, and troubleshooting. Although Chime’s email support and help center can effectively address most customer inquiries, it may not be as instant as other support channels.

MoneyLion, on the other hand, takes a more proactive approach by offering in-app chat support in addition to email and a help center. The in-app chat feature allows users to quickly and conveniently get in touch with a customer support representative, addressing their concerns and resolving issues in real-time. This instant access to support provides MoneyLion users with an enhanced level of customer service.

Final Thoughts on Chime vs MoneyLion

After comparing Chime and MoneyLion across various aspects such as fees, direct deposit, savings accounts, rewards, credit building, and customer support, it is clear that each platform offers unique features and advantages tailored to different user preferences.

Chime shines with its fee-free banking services, high-yield savings account, and automatic savings features, making it an excellent choice for users seeking a simple and cost-effective banking solution. Moreover, Chime’s Credit Builder Visa card offers users a convenient way to build credit without the need for a hard credit check or large security deposits.

MoneyLion, on the other hand, stands out with its comprehensive financial app that offers a wide range of services, including mobile banking, investment accounts, and credit builder loans. Its cashback rewards program and in-app chat support give it an edge over Chime, catering to users who value rewards and real-time customer assistance.

In conclusion, determining the better banking app between Chime and MoneyLion depends on individual user preferences and financial needs. Both platforms offer robust features that cater to different requirements. Prospective users should carefully assess their financial goals and priorities before deciding which banking app is the right fit for their unique circumstances. Other than these banks, you may want to check out Current and Albert banks as well. These companies also offer very promising features and services.