How Much Do I Need to Save? Money Saving Tips for 2025

We’ve all been told to have money for a rainy day – but how many of us have a savings pot? Rising inflation, the cost-of-living crisis, and housing prices mean that most of us are struggling to take control of our finances.

The best time to start saving was yesterday. The second-best time is today. The amount of savings you should have will depend on your age and lifestyle. Starting early means you can take advantage of financial systems like compound interest and pay off debt, alongside starting an emergency fund.

We’re breaking down everything you need to know about saving money in 2025. Understanding money management is key to gaining financial freedom and creating the life you want to live.

How Much Should I Have in My Savings?

There’s no golden number that you should have in your savings account. The reality of life means that not everyone needs the same amount of money. Ideally, you should have enough savings to cover your bills and essentials for 1 to 3 months. This type of savings is known as an ‘emergency fund’ and is a good goal to have at any age.

Any savings beyond your emergency fund will depend on your age and lifestyle. You’ll want to have more in savings if you’re setting money aside for your kids to attend college or if you’re planning to retire early.

There are thousands of articles online that will tell you exactly how much you need to save by a certain age. We recommend taking these with a pinch of salt. Having any money in your savings account is better than nothing. Use these figures as a guideline or a goal, but don’t feel fixed to them.

Start by working out your fixed expenses. These expenses include your utility bills, internet and cell phone costs, rent/mortgage payments, and any insurance you have. Debt payments and an estimate of your variable expenses are also necessary to decide how much you should have in savings.

How much do I need to save in my 20s?

The Federal Reserve’s Board of Survey of Consumer Finances (SCF) estimates that those under 35 have an average savings balance of $11,200.

Your 20s are the ideal time to start working on your savings goals. It’s a time when most people are starting to earn a salary and have disposable income for the first time. Consider your future goals, including your lifestyle choices.

Use your disposable income during your 20s to adopt a budgeting method like the popular 50/30/20 strategy. It involves putting 20% of your budget toward debt repayments and savings with 50% going to needs and 30% to your wants.

Don’t focus solely on saving during your 20s. Compound interest means that your 20s are the perfect time to start investing.

How much do I need to save in my 30s?

The Federal Reserve’s Board of Survey of Consumer Finances (SCF) estimates that those between 35-44 have an average savings balance of $27,900.

The amount of money you have in savings during your 30s will depend on your circumstances. You may have less readily available in a savings account if you just purchased a home or may want to put more aside if you’re saving for your kids’ college funds.

How much do I need to save in my 40s?

The Federal Reserve’s Board of Survey of Consumer Finances (SCF) estimates that those between 45-54 have an average savings balance of $48,200.

However, the Fed’s Survey of Consumer Finances also estimated that the median savings of the average US household were $5,300 – comparable to the median monthly income. It means that most Americans have savings that are equivalent to a one-month emergency fund.

How much do I need to save in my 50s?

The Federal Reserve’s Board of Survey of Consumer Finances (SCF) estimates that those between 55 and 64 have an average savings balance of $57,800. You’ll want to have a large nest egg set aside during your 50s to help sustain you during retirement.

Your 50s are likely when you’ll be making your highest salary, but you may also have more outgoings due to increased responsibilities and financial pressures.

10 Money-Saving Tips

There are dozens of ways you can start saving money. It all starts with making small changes to your daily spending. You don’t have to live frugally to have savings. Proper budgeting will allow you to have the lifestyle you want, while still having savings set aside.

1. Make a Budget

There are various steps you can take to get more value out of your contacts or lower their cost. Increasing your insurance deductibles can lower your premiums, while drivers with a good record can often negotiate a lower insurance premium.

Take a hard look at your monthly subscriptions and cancel any that you’re not actively using. You can always restart these subscriptions again later. One area you may be paying too much for is your phone contract. Look at you’re your data usage and consider dropping to a lower-cost data plan that matches your usage.

2. Pay Off Your Existing Debt

Before you commit to your savings goals, you want to pay off your existing debt. The main concern around debt is the interest fee you pay. The longer your debt remains outstanding, the more you’ll pay in interest.

Depending on your level of debt, it’s possible that you’re being charged hundreds every month in interest. Focus on paying off your existing debt to boost your credit score and free up your deposable income to go towards your savings.

3. Save for Your Retirement

It’s never too early to start saving for retirement. Saving early can give you the freedom to decide to retire early and give you more flexibility later in life. Most people will choose to diversify their retirement savings, putting a portion of it in a high-yield savings account and another part into investment portfolios.

Search around for the best high-yield savings account for your retirement goals. Most high-yield accounts will require you to keep your money in the account and not make a withdrawal within a certain time frame to maintain the higher interest rate.

4. Create an Emergency Fund

Your first savings goal should be to start an emergency fund that will cover at least 2 months of your fixed and variable expenses. You can dip into this emergency fund if you get an unexpected bill or lose your job.

5. Invest In You

Investing in yourself and your skills can save you hundreds every year. Imagine how much money could save if you meal prepped at home instead of eating out multiple times a week. Learning basic repairing skills can save you spending money on professional repairs.

You can also invest in yourself to further your career. Industries are increasingly focusing on the idea of ‘lifelong learning’. Look for opportunities to expand your skills and knowledge, whether through educational institutions, online courses, or mentoring. Progressing your career or exploring new revenue streams can boost your income and enable you to increase your savings to become financially free.

6. Invest in the Stock Market

Compound interest is your best friend. That’s where the stock market outperforms traditional savings accounts. A conservative estimate of the average returns on the stock market sits around 6%. If your portfolio goes up 6% one year, then 6% the next, compound interest will start to kick in. You’ll be earning money on your gains, making them increase in value.

Inflation means that your money has less value year-on-year. Investing in the stock market is one of the best ways to boost your money’s value and keep up with inflation.

Investing app means you have the stock market at your fingertips. You can sign up for top investing apps like Cash App, SoFi, Webull, and Acorns through our referral links to kickstart your investing portfolio.

7. Boost Your Credit Score

Paying off your debt and living within your budget will help to boost your credit score. It’ll increase your chances of being approved for financial assistance and loans, whether you’re leasing a car or buying a house.

Sign up for online banks like Juno, Chime, and Albert to take control of your credit score. Our referral codes will streamline the sign-up process with a bonus to start your account.

8. Automate Your Finances

Getting your finances in order can make your life less stressful. After setting your budget and your financial goals, it’s time to start automating your finances.

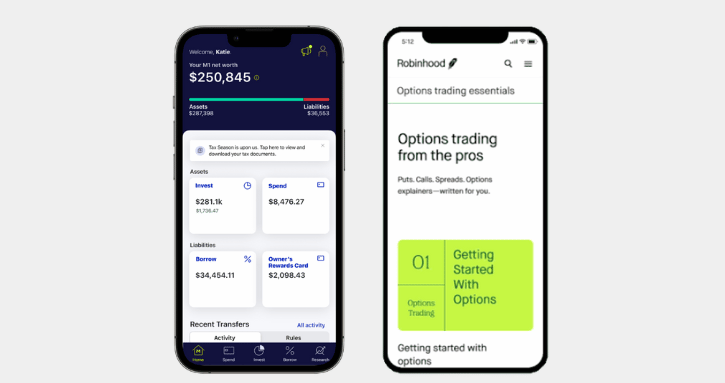

Investment apps like M1 Finance and Robinhood can automate your portfolio, adding money to your account regularly. Start automating your investment by signing up through our M1 Finance and Robinhood referral links for an exclusive sign-up bonus.

9. Set Financial Goals

Start setting financial goals – from the salary you want to earn in 5 years’ to the size of your investment portfolio. Having a number in mind will make it feel more achievable and allow you to track your progress. Take any unexpected money – such as work bonuses, tax refunds, and rebates – to put towards your financial goals, whether it’s paying off debt or hitting a savings goal.

10. Educate Yourself

The reality is that most people are never taught about their finances. It’s how people end up in skyrocketing debt and find themselves unable to invest in their future. You’re taking the first step by reading this guide today.

The internet is full of resources you can use to educate yourself on finances. Podcasts like ‘The Ramsey Show’, ‘Girls That Invest’, and ‘Invest Like the Best’ can make the world of finances feel more accessible.

Final Thoughts: Saving Money In 2025

The best time to start working towards your financial goals is today. Every little helps. Start by looking at your finances, setting a budget, and determining your long-term goals.

There’s no set number that you should have in your savings account by a specific age. Consider your lifestyle and expenses to determine your financial goals. Use this guide as your first step toward financial freedom in 2025.