Top 8 Online Banks in 2025: How to Choose Your Online Bank

Digital banking is revolutionizing the way we treat our money. It’s never been easier to get an instant overview of your finances, control your direct debits, and send money internationally.

Gone are the days of queuing up at the bank or waiting days for payments to arrive. Online banking gives you everything you need directly in an app. Next-generation platforms like Juno, Novo, and Albert are leading the way for online banking.

Take control of your finances by choosing an online provider. Signing up to an online bank using our referral links can earn you an exclusive joining bonus to kickstart your account.

Intro to Online Banking

Online banking is a more streamlined and interactive alternative to traditional financial institutions. Only a few years ago, most people banked with high street banks. It meant transferring money could take days, applying for loans had to happen in person, and everything was done on paper.

Fintech has led to a rise in online banking with companies like Juno, Novo, and Current battling it out to offer the most intuitive platforms and user experience. Switching to online banking allows you to take control of your finances and access virtually every financial service at the touch of a button.

What are the Benefits of Online Banking?

The potential of online banking comes from the platform’s apps. You can do almost anything you would traditionally do in-store through digital platforms. Online platforms streamline banking, enabling you to get an instant overview, easily access your statements, and explore added features.

Every online bank will have its own perk as platforms compete against each other in the ever-growing niche.

1. Convenience

The main reason companies are ditching traditional banks for online platforms is convenience. Almost every financial service, from disputing transactions to exchanging currency and making international transfers, can occur within the app.

High street banks are increasingly closing their physical locations, driving more customers towards online banking. Increasing the control over your finance allows users to make instant payments, manage direct debts, and easily set up payees.

2. Added Features

Dozens of features give online banking an edge over its traditional counterparts. Users get a real-time view of their finances, including pending payments and the ability to search transactions. Online banking allows for both account-t0-account transfers and person-to-person (P2P) transfers using mobile numbers and account names. While most online banking platforms don’t easily facilitate cash deposits, many allow for digital check uploads for easy deposits.

One of the most useful features of online banking is card control. You can instantly freeze your card if it’s stolen or misplaced, along with ordering replacement cards and un-freezing your current card when found. Similarly, online banking offers fraud alerts with instant transaction notifications.

A common misconception around online banking is that it’s not secure to have your financial details on your phone. Most online banks require touch or face ID authentication for added protection or a separate password to access the account, typically your card pin. Online banking also provides self-service options, making it easier to update your contact details, cancel direct debts, and control your cards without having to deal with customer service.

3. Cost

Every online bank will have its own fees. You’ll want to consider your financial needs when deciding which one works best for you. Most online banking platforms are free to sign up for, however, some do charge a small monthly fee.

Using our online banking referral links can help you kickstart your account with a sign-up bonus to offset any initial costs.

4. Record Keeping

Keeping track of your bank statement isn’t easy. Most traditional banks will send you a paper copy of your statement, meaning you’ll have to request a digital copy if required.

Online banking makes record keeping easy with innovative user interfaces that enable you to instantly access your statements and transactions. Search functions can enable you to focus your search on a specific merchant, category type, or location.

How to Choose Your Online Bank

The world of online banking is becoming more competitive as users start increasingly switching from high street banks. You’ll want to consider your financial position and your lifestyle needs when choosing the best online bank for you.

There are 8 factors you should consider when comparing online banks in 2023.

1. APYs

The annual percentage yield (APY) is the rate of return that is earned on your investment that considers compounding interest. You’ll see APY applied to individual retirement accounts (IRAs), savings accounts, and certificates of deposit (CDs). If you’re working towards saving goals and want an online bank that will give you the best return, focus on comparing APYs.

2. ATM Network

One factor that is often overlooked with online banking is the ATM network. Unlike traditional banks, not every online bank account will have access to free ATM withdrawals.

Some online banks, such as Monzo, will provide free ATM withdrawals within a specific region with a limited free allowance in certain regions before fees start to apply. You’ll want to consider the ATM network if you plan on using your online bank account as your primary account and need regular cash withdrawals.

3. Customer Experience

Customer experience is one of the major selling points for online banks. Unlike traditional banks, you’ll be able to reach out to customer service directly through your app. Most online banks are self-service, allowing you to order new cards, control direct debts, and apply for credit without needing to contact a customer representative.

We recommend reading reviews for online banks, comparing referral programs, and using Trustpilot to see what users have to say about their experience.

4. Digital Banking Experience

Digital banks are only as good as their user interface and banking experience. You want to choose a platform that has an innovative user interface that is easy to navigate and operate. Most online banks will operate exclusively through an app, while others will also have a desktop website. Read up on the digital banking experience and familiarize yourself with the UI.

5. Fees

While most online banks offer zero-fee current accounts, some have fee-paying accounts to access top-tier features. You’ll want to consider your financial needs and lifestyle to decide whether a fee-paying account is right for you. Fees are typically charged monthly as a direct debt.

6. Minimums

Specific online bank accounts may require you to make a minimum deposit to open your account. This minimum will typically range anywhere from 25 to $100. Most online bank referral programs will require a specific minimum deposit to unlock the sign-up bonus. Private banking and investment accounts will have a higher minimum deposit.

7. Products

Online banks are increasingly expanding beyond current accounts. Consider your financial needs and compare the products offered by online banks, including overdrafts, loans, credit cards, and high-yield savings accounts.

8. Safety

Safety is one of the most important features of online banking. Most apps will offer two-factor verification or touch/face ID authentication. Compare the safety features of online banks when choosing the best one for 2023.

Best Banks in 2023

Struggling to compare online banks? We’re rounding up the 8 best digital banks for 2023. Use our online bank referral codes to kickstart your account and boost your balance.

1. Albert

Albert is an online bank that utilizes powerful technology to automate your finance with a team of experts behind it to guide your financial decision-making. This digital bank offers a simple solution for banking, saving, and investing in one platform. There are no minimums and the option to get paid early while starting your portfolio from just $1.

One thing you should check out when opening a new bank account is their referral program. Because it offers a $150 signup bonus when you sign up using an Albert referral link, the Albert referral program stands out as one of the more generous options.

2. Chime

Chime is a financial technology company that offers an overdraft fee-free program of up to $200. It offers innovative features like getting paid by direct deposit up to 2 days early. Chime’s main benefits include zero monthly fees, no foreign transaction fees, and access to over 60,000+ fee-free ATMs.

This is a fantastic moment for new Chime bank customers to sign up, receive a sizable referral bonus, and take advantage of all this fantastic online bank has to offer. Check out this Chime referral article for the complete guide.

3. Current

Current is ‘mobile banking done better’ with a lucrative savings account that offers 4% APY. This fintech company is building the future of banking with no minimum fees, faster paydays, and smarter tools. You can earn points to put towards cashback rewards while using your Current card.

Utilize our Current Bank referral link to join over 4 million members and open a current account to receive $50 after making a $200 deposit.

4. Juno

Are you looking to start your crypto portfolio? Juno is an online banking platform that offers crypto investing alongside a checking account. You can trade 35+ cryptocurrencies from an FDIC-insured checking account that earns a 5% yearly bonus. This bonus is competitive compared to Robinhood’s 1.5% and SoFi’s 3.75%.

When you sign up for an account using our Juno referral code: M1R1IE6D, you can receive $10 and 500 JCOIN for free. You can further increase your earnings by inviting your friends to Juno.

5. Netspend

Netspend offers a series of financial products that put you in control of your money. Its prepaid card is trusted by millions with $0 monthly fees when you load $1,000 or more into your account each calendar month. The app offers anytime alerts and a spending tracker to easily control your finances.

As per the motto of Netspend, “Friendship is Better with an Additional $40,” join up right away using a Netspend referral link to receive a $40 welcome bonus and to promote your friends as well. When you refer a friend, you can each get a $40 incentive when you satisfy all the referral requirements.

6. Novo

Novo offers free business checking accounts that are trusted by over 200,000 small businesses. It offers easy transfers with no hidden fees with most applications taking less than 10 minutes through our Novo referral link. ‘Novo Boost’ allows you to get paid faster at no extra cost.

Use our Novo referral link to sign up right away to take advantage of the chance to receive the Novo referral bonus. Follow the detailed instructions in our Novo referral article.

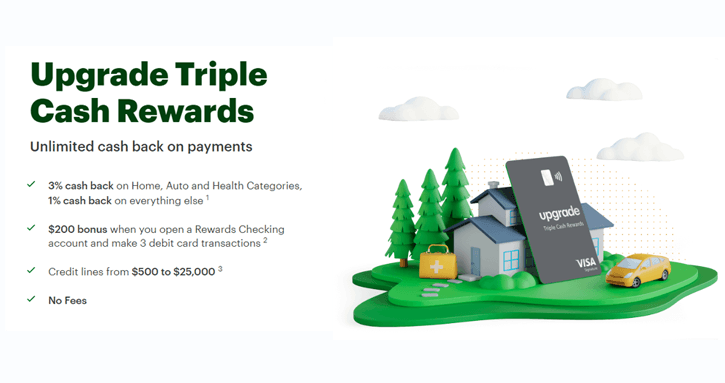

7. Upgrade

Upgrade is a bank account that allows you to get rewarded with no annual fee through its triple cash rewards card. You can check if you’re pre-approved within minutes by signing up through our Upgrade referral link. Upgrade offers a no-fee checking account with personal loans that allow you to borrow up to $50,000.

8. Varo

Varo is an online bank that offers checking accounts and high-yield savings account with no hidden fees. There are no credit checks, minimum balance requirements, or monthly fees associated with Varo. You’ll also get access to over 55,000 fee-free Allpoint ATMs with the option to earn up to 6% cashback when using your Varo cards.

With no monthly fees or required minimum balance, opening a current account with Varo is simple. Follow this Varo referral guide for the whole sign up process.

Final Thoughts: Online Banking in 2025

Take control of your finances by swapping from our high street bank to an online bank. There’s an online banking service out there for everyone, whether you’re building your investment portfolio or sending international payments.

You want to consider your financial position and lifestyle when choosing which online bank is right for you. Use our online bank referral codes to get exclusive sign-up bonuses when opening your current account.