Budgeting 101: A Step-by-Step Guide on How to Budget Your Money

Financial freedom is something we all strive for, but it can often be challenging to achieve. Budgeting is one of the most powerful tools to help you reach your financial goals. It’s an essential part of managing your money and is often the key to unlocking financial freedom.

In this blog post, we’ll discuss what budgeting is, the benefits of budgeting, how to develop a budget, popular budgeting apps, and more. Let’s dive in!

Introduction to Budgeting

Budgeting is the process of creating a plan to spend your money. It involves setting goals for how much you want to save and tracking your spending so you can make sure you’re staying on track. Budgeting helps you to stay organized and make sure you’re making the most of your money. It also helps you to set financial goals and make sure you’re keeping them.

A budget should include all of your income and expenses, including your bills, groceries, debt payments, and discretionary spending. It should also include your savings goals. By creating a budget, you can identify areas where you can save money or cut back on spending.

Benefits of Budgeting

It helps you stay organized. A budget can help you keep track of your income, expenses, and goals. It can also help you stay on top of payments and ensure you’re not overspending.

It can help you save money. A budget can help you identify areas where you can reduce spending and save money. It can also help you set realistic financial goals and track your progress.

It can help you reach your financial goals. A budget can help you reach your financial goals faster by helping you focus on the things that matter most. It can also help you stay motivated and on track by tracking your progress.

Developing a Budget

Developing a budget is a key step in achieving financial freedom. Here are some tips for creating a budget:

Start with your income. Begin by listing all of your sources of income, including your salary, investments, side hustles, etc. This will help you determine how much money you have to work with.

Track your spending. Track your spending for a few months to get an idea of where your money is going. This will help you identify areas where you can cut back.

Set a budget goal. Set a goal for how much you want to save each month. This will help you stay focused on your financial goals.

Create a budget. Create a budget that includes all of your income and expenses. Be sure to include your savings goals as well.

The 50/20/30 Rule

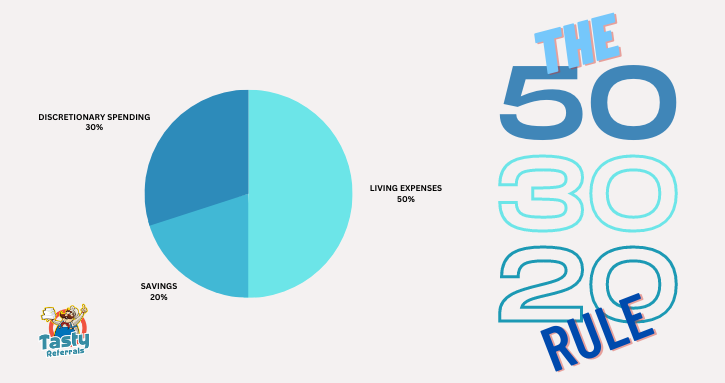

The 50/20/30 rule is a popular budgeting strategy that can help you manage your money more effectively. It involves allocating 50% of your income to living expenses, 20% to savings, and 30% to discretionary spending. This helps ensure that you’re saving enough money each month and not overspending.

Living expenses include things like rent, utilities, groceries, and transportation. Savings should include things like a retirement account, emergency fund, and other long-term investments. Discretionary spending should include things like entertainment, dining out, vacations, and other non-essential purchases.

Tracking Your Spending

Tracking your spending is an important part of budgeting. It involves tracking how much money you’re spending each month on things like rent, groceries, and entertainment. Tracking your spending can help you identify areas where you can cut back and save more money.

You can track your spending manually by keeping receipts and writing down your expenses, or you can use budgeting apps to automate the process. Budgeting apps are especially useful for tracking expenses that occur regularly, such as rent and utilities.

Setting Financial Goals

Setting financial goals is an important part of budgeting. A financial goal could be anything from saving for a house or car to paying off debt. Whatever your goal is, it’s important to have a plan in place to make sure you’re staying on track.

When setting financial goals, set a timeline for when you want to achieve them. This will help you stay motivated and focused on reaching your goals. You should also set smaller, more achievable goals along the way to keep yourself on track.

Tips for Sticking to a Budget

Sticking to a budget can be difficult, but there are some tips you can use to help make it easier:

Automate your bills. Automating your bills can help you stay on top of payments and ensure that you’re not overspending.

Set a reminder. Set a reminder on your phone to check your budget weekly or monthly. This will help you stay on track and ensure you’re not overspending.

Reward yourself. Budgeting can be difficult, so it’s important to reward yourself when you reach a goal. This will help you stay motivated and keep you on track.

Track your progress. Track your progress toward your financial goals to help you stay motivated. You can use budgeting apps to track your progress and stay on top of your goals.

Popular Budgeting Apps

Budgeting apps can be a great tool for managing your money and staying on track. There are a variety of budgeting apps available, so it’s important to find one that works for you. Some of the most popular budgeting apps include Mint, YNAB, and Wally.

Mint is a free budgeting app that helps you track your income and expenses. It also offers a variety of other features, including budgeting tools, bill reminders, and investment tracking.

YNAB is another popular budgeting app that helps you track your spending and set financial goals. It also offers budgeting tools and tips to help you stay on track.

Wally is a great budgeting app for those who are just getting started with budgeting. It helps you track your expenses and set financial goals. It also offers budgeting tips and a budgeting calculator to help you stay on track.

Dealing With Debt

Dealing with debt can be a difficult and overwhelming process. It’s important to make sure you’re budgeting for your debt payments and making progress towards paying it off. Here are some tips for dealing with debt:

Create a plan. Create a plan for how you’re going to pay off your debt. This should include a timeline for when you want to be debt-free and a budget for how much you can afford to pay each month.

Pay more than the minimum. Paying more than the minimum payment each month can help you pay off your debt faster.

Cut back on expenses. Cut back on unnecessary expenses and use the money towards your debt payments.

Consolidate your debt. Consolidating your debt can help you get a lower interest rate and make it easier to pay off your debt.

Start Investing

Investing can be a great way to manage your money and increase your long-term wealth. With investing apps, it’s easier than ever to get started.

Investing is not only a great way to save money, but it can also provide you with the opportunity to make money. When you invest, your money has the potential to grow over time, allowing you to build up your wealth.

The best investing apps will depend on your individual needs and goals. Some popular investing apps include Acorns, Robinhood, Stash, M1 Finance, and Wealthfront.

Acorns is a micro-investing app that allows you to invest small amounts of money in a diversified portfolio.

Robinhood is a commission-free trading platform that allows you to buy and sell stocks and ETFs.

Stash is an app that offers access to a wide variety of investments, including stocks, ETFs, and mutual funds.

M1 Finance is a commission-free trading platform with automated investing features.

Wealthfront is an automated investing platform that allows you to set up and manage your investment portfolio with minimal effort.

Investing apps make it easy to get started. You can easily set up an account, select investments, and set up automatic contributions to your portfolio. Many investing apps also provide features such as portfolio tracking and detailed analytics. This makes it simple to monitor your investments and help you make great decisions. Learn more investing tips here.

Conclusion

Now that you know how to budget, you can start taking steps towards achieving financial freedom. Start your journey by creating a budget and tracking your spending. Make sure to set realistic financial goals and use budgeting apps to help you stay on track. With these tips, you’ll be on your way to dealing with your money wisely.